VN-Index is likely to retreat to a deeper support level around the 1,245 (+/-5) point area.

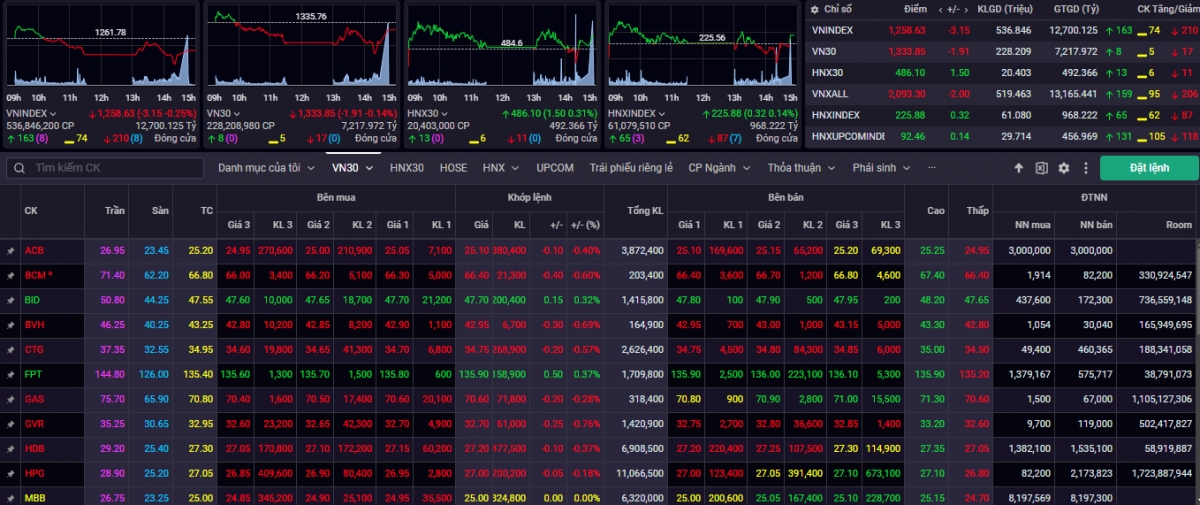

After 2 sessions of recovery at the support zone of 1,250 points, VN-Index was under pressure to correct at the resistance around 1,265 points. At the end of the trading session on October 30, VN-Index decreased by -3.15 points (-0.25%) to 1,258.63 points. Liquidity decreased slightly compared to the previous session with matching volume of -3.18% at HOSE. This shows relatively normal correction pressure. The market was divided, leaning towards negative with 170 stocks decreasing in price, 143 stocks increasing in price and 57 stocks maintaining the reference price. Positive stocks focused on stocks with good growth in business results in the third quarter. Foreign investors maintained net selling in today's session with -143.88 billion VND.

According to experts from Agribank Securities Company (Agriseco), on the technical chart, VN-Index had difficulty breaking out of the near resistance level at the 1,267-point area. Stronger supply at the end of the morning session caused the index to retreat to fill the gap created in yesterday's trading session. Although forming a candlestick pattern with a short leg, VN-Index has not been able to confirm a return to the uptrend as investor sentiment is relatively cautious in the context of the market not having a leading industry group and demand is still quite reserved.

Agriseco maintains the view that the index will continue its tug-of-war trend in the current trading week and is likely to retreat to a deeper support level around the 1,245 (+/-5) point area to stimulate new demand to participate.

“Investors should limit new disbursements and keep cash ratio at a safe level to ensure a proactive position when the market experiences discounts to more attractive price ranges,” Agriseco experts noted.

VN-Index may retest the resistance zone of 1,270 - 1,275 points

According to the analysis team of ASEAN Securities Company (ASEANSC), the market fluctuated within a narrow range and consolidated the balance zone of 1,257 points. Momentum improved but liquidity remained sluggish, lacking the driving force from large stocks, creating a period of mainly sideways movement. The market tended to continue consolidating the balance zone and recovering slowly. From a macro perspective, world oil prices remained stable at a 3-year low after a shock increase and decrease in the first half of October, DXY and domestic exchange rates showed signs of slowing down in the last 3 sessions after a strong increase in the past time, at the same time, SBV began to make net injections back into the market, helping the general sentiment to be more positive after a period of great pressure.

“The market is expected to have short-term recovery sessions. Investors should closely monitor exchange rate movements and SBV's moves on monetary policy, and consider disbursing when signs of a recovery trend appear more clearly along with trading volume. We maintain a positive assessment of the medium- and long-term market, focusing on stocks with good fundamentals and positive Q3 business results, waiting to disburse when stocks reach attractive valuations or confirm a recovery trend,” said an expert from Agriseco.

Sharing the same view, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may return to the recovery rhythm in today's session, October 31, and the VN-Index may retest the resistance zone of 1,270 - 1,275 points. At the same time, the market is only in the technical recovery phase, although buying points are gradually appearing in the Midcaps and Smallcaps groups of stocks, and short-term risks in these two groups of stocks are also decreasing. In addition, the short-term sentiment indicator increased slightly, showing that investors have also become less pessimistic about the current market developments.

“The short-term trend of the general market remains bearish. Therefore, investors can continue to hold a low proportion of stocks at 30-40% of their short-term portfolio and can buy new stocks at a low proportion to explore the short-term trend. At the same time, investors should limit selling at the current stage,” YSVN experts recommended.

► Some stocks to watch on October 31

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-3110-vn-index-co-the-thu-thach-lai-vung-khang-cu-1270-1275-diem-post1132117.vov

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)