VN-Index returns to 1,270 points; List of 7 potential real estate stocks; Dividend payment schedule...

VN-Index increased positively for 3 consecutive weeks amid divergence risks

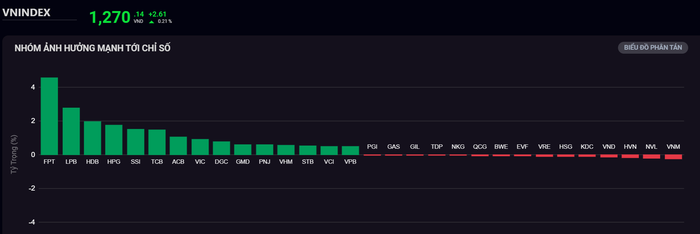

At the end of last trading week, the VN-Index remained at 1,270 points, up slightly by 2.6 points.

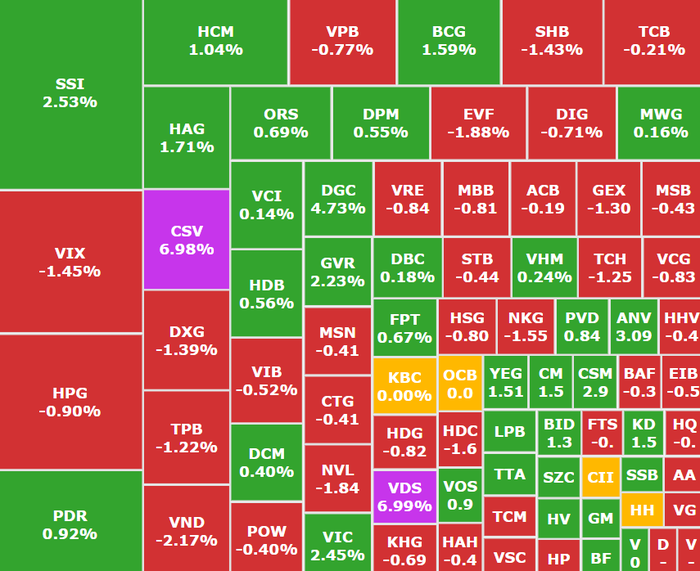

After a sudden increase of nearly 30 points on December 5 thanks to the push from the VN30 pillar stocks, by the end of the week, this group of stocks gradually weakened, turning red, causing the market's growth momentum to narrow significantly. Although GVR, VIC ( Vingroup , HOSE) and SSI (SSI Securities, HOSE) increased, it was still not enough to pull the market up as high as before.

The state of differentiation spread across most large stock groups, in which large-cap groups including real estate, banking and securities were all under strong selling pressure.

The production group also could not avoid the impact with HPG ( Hoa Phat Steel, HOSE), HSG (Hoa Sen Steel, HOSE)...

Some bright spots appeared at VIC (Vingroup, HOSE) up 2.5%, DGC up 4.7%...

Liquidity recovered and maintained at the threshold of 20,000 billion VND.

Foreign investors continued to net buy VND 281 billion at SSI (SSI Securities, HOSE), HPG (Hoa Phat Steel, HOSE) and MSN ( Masan , HOSE).

Green dominates, VN-Index recovers to 1,270 points (Photo: SSI iBoard)

Overall, thanks to the breakout session on December 5, the market maintained a positive tone all week, with a recovery of nearly 20 points, equivalent to an increase of 1.57% compared to the previous week, liquidity improved significantly with an average matched value of 13,480 billion, an increase of 33%.

The index returned to the 1,270 point mark after about 3 gloomy months, but many experts said that investors should still be cautious about the risk of differentiation not only between industry groups but also between stocks within the industry groups.

The race to increase capital at the end of the year in the securities industry

Recently, Asean Securities Corporation (Aseansc) announced to seek shareholders' written opinions on the plan to offer 50 million shares to existing shareholders to increase charter capital.

With 50 million shares offered, equivalent to 50% of the outstanding shares, the company plans to increase its charter capital from VND 1,000 billion to VND 1,500 billion. The offering period is in 2024 - 2025, the expected price is not lower than VND 10,000/share and will be fully disbursed in 2025.

Previously, Aseansc's most recent capital increase took place in 2017, raising the company's charter capital from VND500 billion to VND1,000 billion.

The capital increase move is not a story unique to Aseansc, many other securities companies have also simultaneously planned to increase capital at the end of this year such as MBS, TCBS, SSI...

Real estate stocks are booming, with the potential to increase up to 30%

According to ACB Securities (ACBS) , the real estate market is entering a recovery phase thanks to support from the legal corridor, interest rates, supply, and buyer psychology.

Specifically, in reality, after a period of restricting new investments to focus on restructuring, handling financial obligations and observing the market situation, real estate investors have returned to operations to deploy and launch new projects and subdivisions. Many projects have had their legal problems resolved and are eligible for implementation, while businesses have basically completed the handling of bond obligations, bringing their financial status to a safe level and overcoming the market's purification phase.

Therefore, ACBS believes that the real estate market is assessed to have passed the reversal point and will begin to enter a new growth cycle from 2025 thanks to the following supports: (1) New legal corridor, promoting new supply; (2) Homebuyer sentiment continues to improve for both residential and investment needs; (3) Interest rates are maintained at a reasonable level and projects have more conditions to mobilize credit; (4) Driving force from infrastructure when some projects begin to complete in 2025 and the trend of accelerating public investment disbursement; (5) Sales activities and announcement of new projects by investors.

Thanks to that, ACBS has come up with 7 real estate names with the potential to increase in price from 15% - 30%, including:

- KDH (Khang Dien House Investment and Trading JSC) expects to increase by 19.3%;

- NLG (Nam Long Investment Corporation, HOSE) expects to increase by 24.4%;

- PDR (Phat Dat Real Estate Development Corporation, HOSE) expects to increase by 22.6%;

- HDG (Ha Do Group Corporation, HOSE) expects to increase by 16.5%;

- DPG (Dat Phuong Group Corporation) expects to increase by 28.8%;

- HDC (Ba Ria - Vung Tau Housing Development Corporation) expects to increase by 24.8%, AGG expects to increase by 26%.

Comments and recommendations

Mr. Pham Thanh Tien, Investment Consultant, Mirae Asset Securities, assessed that VN-Index had a rather active trading week when large-cap stocks returned to their role as market leaders quite well. Especially the session on December 5, the "psychological relief" session, this is considered a key session to help consolidate the current recovery trend that can be maintained to the old peak around 1,300 points.

Large-cap stocks return to lead the market, expected to reach 1,300 points

Another bright spot comes from the group of foreign investors who have shown signs of returning to large-scale net buying of nearly 1,000 billion VND.

In addition, regarding macro information, the event about Vietnam's emerging market upgrade process from FTSE organization shows a clearer roadmap, creating expectations for the return of foreign capital flows when the upgrade process is completed.

Therefore, in the short term, market inertia is forecast to continue to recover this week, and VN-Index is expected to move up to the important 1,300 point mark.

In the medium term, the main trend is still accumulation within the large range of 1,200 - 1,300 points. Because, the macro factors have not changed much, credit growth and high import-export growth, strong recovery of retail sales, monetary policy remains loose. Therefore, the possibility of the market entering a new price increase cycle at the end of this year and early next year is relatively bright.

Industries that can be considered for that investment position are retail and construction materials stocks.

KB Securities believes that the VN-Index faced increased selling pressure again at the end of last week, however, the demand is still quite good, the active selling is still under control and has maintained part of the increase. The short-term uptrend is the main trend, the VN-Index is expected to regain its recovery momentum soon and have a basis to maintain the upward momentum to the resistance zone around 1,300 points. Investors can continue to increase the proportion if the index or target stock code shows another correction, returning to the near support zone.

BSC Securities commented that the VN-Index increased positively last week with the number of stocks increasing more than the number of stocks decreasing, showing that the cash flow tends to differentiate. Foreign investors were net buyers on the HOSE floor and net sellers on the HNX floor, profit-taking pressure appeared after a strong increase. Therefore, in the coming sessions, the trend of the VN-Index will depend on the cash flow of investors in the psychological zone of 1,265 - 1,270 points.

Dividend payment schedule this week

According to statistics, there are 23 enterprises that have dividend rights from December 2-6, of which 19 enterprises pay in cash, 3 enterprises pay in shares and 1 enterprise issues additional shares.

The highest rate is 90%, the lowest is 4.8%.

3 businesses pay by stock:

Vietnam National Reinsurance Corporation (VNR, HNX) ex-dividend date is December 11, rate is 10%.

Ho Chi Minh City Development Joint Stock Commercial Bank (HDB, HOSE), ex-dividend date is December 11, rate is 20%.

Equipment Joint Stock Company (MA1, UPCoM), ex-right trading date is December 11, ratio is 90%.

1 additional issuer:

Military Insurance Corporation (MIG, HOSE), ex-dividend date is December 9, rate is 15%.

Cash dividend payment schedule

* Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Global Education Day | Day TH | Proportion |

|---|---|---|---|---|

| MPC | UPCOM | December 9 | 9/1 | 7.5% |

| LBM | HOSE | December 9 | December 26 | 10% |

| MCC | HNX | December 9 | December 25 | 4.8% |

| VMD | HOSE | December 9 | December 20 | 20% |

| HD6 | UPCOM | December 9 | December 20 | 10% |

| C21 | UPCOM | December 10 | December 24 | 5% |

| BSQ | UPCOM | December 10 | December 24 | 5% |

| A32 | UPCOM | 11/12 | 3/1 | 10% |

| TMP | HOSE | 11/12 | December 24 | 18% |

| ABI | UPCOM | December 12 | December 24 | 10% |

| PMC | HNX | December 12 | December 25 | 55% |

| SIP | HOSE | December 12 | December 25 | 10% |

| DNH | UPCOM | December 13 | January 15 | 12% |

| THG | HOSE | December 13 | 8/1 | 10% |

| QHD | HNX | December 13 | January 15 | 20% |

| DVC | UPCOM | December 13 | 10/1 | 7% |

| PHR | HOSE | December 13 | December 27 | 30% |

| WSB | UPCOM | December 13 | December 27 | 20% |

| VDP | HOSE | December 13 | January 16 | 10% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-9-13-12-vn-index-duoc-ky-vong-chinh-phuc-1300-diem-20241209093504851.htm

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)