Cash flow focused on large-cap stocks such as VHM, VPB, and MWG, helping the index representing the Ho Chi Minh City Stock Exchange increase by nearly 12 points, thereby extending the second session's increase and approaching the 1,230-point mark.

Cash flow focused on large-cap stocks such as VHM, VPB, and MWG, helping the index representing the Ho Chi Minh City Stock Exchange increase by nearly 12 points, thereby extending the second session's increase and approaching the 1,230-point mark.

After yesterday's recovery session, some experts said that VN-Index could fluctuate strongly in the short term as investors took advantage of the opportunity to sell their stocks. Reality has partly proven these comments when VN-Index fluctuated strongly right at the opening session on November 21. Before the lunch break, investors began to disburse into large-cap stocks, thanks to which the electronic board gradually turned green and remained in this state until closing. The index representing the Ho Chi Minh City Stock Exchange closed today's session at 1,228.33 points, up 11.79 points compared to the reference.

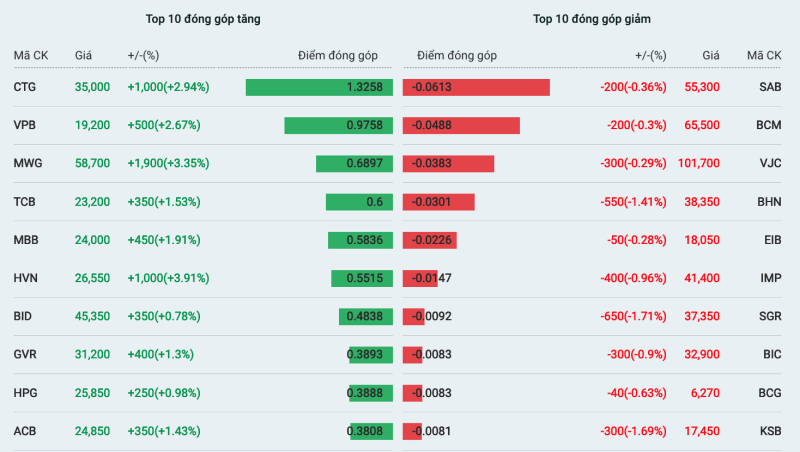

VN-Index had 278 stocks closing in green, 3 times higher than the 94 stocks closing below reference. The main driving force in today's session mainly came from large-cap stocks. This was shown by the fact that the index representing the VN30 basket accumulated nearly 15 points compared to the previous session. Most of the top 10 stocks on the list of stocks positively impacting the market are in this group.

|

| List of stocks that have the most positive and negative impact on the market. |

Specifically, CTG became the main driving force in today's session when it increased by 2.94% to 35,000 VND. Next, VPB increased by 2.67% to 19,200 VND, MWG increased by 3.35% to 58,700 VND, TCB increased by 1.53% to 23,200 VND, MBB increased by 1.91% to 24,000 VND. The remaining large-cap stocks on the above list are BID, GVR, HPG andACB .

Market liquidity today reached VND12,179 billion, down VND5,628 billion compared to the previous session. This is the session with the lowest matching value in the past half month. Trading volume decreased by 285 million units, reaching 482 million shares. Of which, the large-cap basket contributed more than 228 million shares in trading volume and matching value of more than VND7,462 billion.

VHM leads in terms of turnover value with over VND1,493 billion (equivalent to 34.4 million shares). The following codes are VPB with over VND529 billion (equivalent to 27.8 million shares), MWG with over VND472 billion (equivalent to 8.2 million shares) andFPT with over VND419 billion (equivalent to 3.2 million shares).

The oil and gas group also contributed significantly to today's increase. Specifically, PVD increased by 1.7% to VND23,600, PLX increased by 1.2% to VND39,050, GAS and POW both increased by 0.9%, to VND68,200 and VND11,450, respectively.

Fertilizer group recorded exciting trading when most closed above reference. Of which, DPM increased 3.1% to 34,850 VND, BFC increased 2.3% to 38,200 VND and DCM increased 2.2% to 37,400 VND.

On the other hand, SAB faced strong profit-taking pressure, causing its market price to fall 0.36% to VND55,300 and taking away more than 0.06 points from the VN-Index. BCM ranked next in the list of negative impacts on the index when it fell 0.3% to VND65,500.

The market increased for the second session, but the net selling streak of foreign investors has not shown any signs of stopping. Specifically, this group sold nearly 68 million shares in today's session, equivalent to a transaction value of more than VND 2,327 billion, while only disbursing more than VND 1,469 billion to buy 44 million shares. The net selling value is approximately VND 858 billion. This is the sixth consecutive session that foreign investors have net sold over VND 500 billion.

Foreign investors aggressively sold VHM with a net value of approximately VND587 billion, followed by SSI with about VND130 billion, HPG with more than VND118 billion and MWG with nearly VND105 billion. In contrast, foreign cash flow focused on banking stocks with CTG reaching a net value of nearly VND67 billion. TCB ranked next with a net absorption of more than VND52 billion and VPB with more than VND43 billion.

Source: https://baodautu.vn/vn-index-tang-manh-phien-thu-hai-nho-co-phieu-von-hoa-lon-d230610.html

Comment (0)