Untangling the market

Decree 232/2025 (Decree 232) of the Government amending and supplementing Decree 24/2012 on the management of gold trading activities, issued at the end of August and taking effect from the beginning of October, is considered to remove many bottlenecks for the gold market. Specifically, the new decree supplements the conditions for granting licenses to enterprises and commercial banks participating in the production of gold bars. Units are only allowed to produce, trade, buy and sell gold bars according to regulations. At the same time, the Government also ended the mechanism of State monopoly on gold bar brands, expanding the subjects allowed to import raw gold. Enterprises and commercial banks licensed to import gold are only allowed to import gold bars and raw gold with a content of 99.5% or more and announce the applicable standards, volume and content of imported gold bars and raw gold according to regulations and are responsible for the announced applicable standards. Enterprises and commercial banks must be responsible for the gold bars they produce, guarantee gold bars for customers according to regulations; fully and accurately store data on produced gold bars; build an information system to process and store data on produced gold bars as well as connect and provide information to the State Bank (SBV) according to regulations of the SBV Governor...

According to the provisions of Decree 232, in terms of charter capital alone, there will be a number of enterprises and commercial banks that meet the conditions to be granted a license to produce gold bars and import raw gold, including Saigon Jewelry Company - SJC, Phu Nhuan Jewelry Joint Stock Company (PNJ) and Doji Jewelry Group, which meet the condition of charter capital of over VND 1,000 billion. At the same time, there are 8 banks including Vietcombank, BIDV, VietinBank, Agribank, VPBank, Techcombank, MB andACB with charter capital of over VND 50,000 billion. Thus, the number of units producing gold bars and importing raw gold will increase significantly.

Decree 232/2025 of the Government on gold market management will make the market develop more transparently and diversely.

PHOTO: NGOC THANG

Ending the State’s monopoly on gold bar brands and expanding gold bar production units as well as importing raw gold will help diversify the gold supply in the market. People will have more choices and the market will be more competitive and transparent. This will help narrow the gap between domestic and international gold prices as well as between gold brands.

For the gold jewelry market, the new decree also allows businesses and commercial banks that meet the conditions to import raw gold. This regulation will help increase the official gold supply, increase transparency and stabilize the supply, creating conditions for gold jewelry manufacturing businesses to confidently invest long-term. With the participation of potential businesses and commercial banks, the import and distribution of raw gold will be professional and transparent, ensuring the ability to meet the needs of the jewelry and handicraft manufacturing industry nationwide. The State Bank will coordinate with relevant ministries and branches to continue researching and proposing other synchronous mechanisms and policies, contributing to promoting the development of the domestic gold jewelry market.

Notably, in addition to removing bottlenecks in a number of regulations on gold market management, the State Bank said that in implementing the General Secretary's direction, this agency is urgently researching and consulting international experience to propose applying the roadmap for the implementation of establishing a National Gold Exchange; or allowing gold to be traded on the Commodity Exchange or establishing a Gold Trading Floor in the International Financial Center in Vietnam.

Reduce the difference in domestic and world gold prices

Allowing more businesses to import raw gold will help reduce the difference in domestic and foreign gold prices.

PHOTO: DAO NGOC THACH

Mr. Huynh Trung Khanh, Vice President of the Vietnam Gold Business Association, assessed that Decree 232 will help the gold market enter a new phase. The increased supply of gold in the market will shorten the price gap between domestic and foreign markets, and at the same time, people will have more choices when many other gold bar brands appear on the market. Current reality shows that the limited supply of gold leads to people holding gold wanting to hoard it, not wanting to sell it when they are worried about not being able to buy it back, making the price of gold even more expensive. Therefore, eliminating the monopoly on gold bars and allowing the import of raw gold will relieve the supply in the market. When many brands appear on the market, consumers will have more choices and prices will be more competitive. As for the gold jewelry industry, according to Mr. Huynh Trung Khanh, allowing the import of raw gold helps increase the official supply in production activities, making businesses more secure in business. Goods bought and sold all have invoices and clear origins.

Emphasizing that the Government has removed some previous regulations through Decree 232, Dr. Le Xuan Nghia, former Vice Chairman of the National Financial Supervision Committee, said that when the new regulations are officially applied (from October 10), the gold market will overcome the problems that have existed in the past. That is, the gap between domestic and world gold prices will be shortened; gold smuggling will be limited and people will also find it easier to buy and sell... This expert analyzed: with the removal of the state monopoly on the production and branding of SJC gold bars, as well as allowing a number of qualified enterprises and commercial banks to import gold, the domestic gold price will immediately cool down. The domestic gold price still follows the world price but will certainly only differ from the world price by about 2% as before, corresponding to only about 2 million VND/tael higher due to taxes and fees. At the same time, smuggling will also not be as common when the price difference is reduced.

Sharing the same view, financial expert, Dr. Nguyen Tri Hieu, said that Decree 232, when issued and applied, will gradually make the gold market more transparent. At that time, the gold supply in the market will increase and become more transparent. The problem that has existed for many years in the gold market is the lack of supply, leading to prices being pushed up when buyers' demand increases. At this time, the decree has not yet taken effect, so there is still no additional supply, but in the coming time, the gold market will diversify its products for consumers to choose from instead of only having SJC gold bars as at present. When the gold market increases competition and transparency, the price difference between domestic and foreign markets will inevitably narrow.

"There are two expectations when Decree 232 takes effect from October onwards: gold transactions on the market will be more transparent, and the supply of raw gold for production activities will also have more direction. Meeting these two expectations, the gold fever will decrease, and the domestic gold price will reduce the difference higher than the world price to about 3 - 5 million VND/tael," Dr. Nguyen Tri Hieu emphasized.

Allowing more businesses to import raw gold will help reduce the difference in domestic and foreign gold prices.

PHOTO: DAO NGOC THACH

Towards a transparent market

According to Dr. Nguyen Tri Hieu, domestic gold prices are still affected by world prices and the precious metal is currently in an upward channel. It is only the third quarter of 2025, but the world gold price has set a record of over 3,600 USD/ounce, far exceeding all forecasts from the beginning of the year. Political fluctuations in the world, US tariffs, a weakening US economy... have caused prices to skyrocket. In the current period, the FOMO (fear of missing out syndrome) mentality is taking place, so many people buy gold despite the price being up to 20 million VND/tael higher than the world price (equivalent to nearly 15% higher). Because of such a high difference, investors will bear risks and losses when domestic prices reverse despite the world price possibly increasing. The State Bank may grant licenses to banks and enterprises that meet the conditions to import gold for production next month. Therefore, current gold buyers need to be cautious.

In order for the gold market to become more transparent, Mr. Nguyen Tri Hieu said that there needs to be a gold trading floor to control the buying and selling transactions on the market, to know who the buyers and sellers are. From there, the market management agency will gradually grasp how much gold is left in the population. At the same time, gold trading will gradually move towards gold certificates instead of physical gold as it is now. Gold certificates traded on the floor require high liquidity, so no one holds physical gold. "Close compliance with Decree 232 will help the market become more transparent, hopefully changing the market in a more perfect direction," said Mr. Nguyen Tri Hieu.

Dr. Le Xuan Nghia also reiterated the need to implement new regulations as soon as the decree takes effect. Do not worry too much about gold imports affecting the amount of foreign currency in the country. For example, every year we import about 3.5 billion USD worth of cosmetics, if we add the purchase of cigars and foreign wine, just these 3 luxury goods will amount to tens of billions of USD. These products are finished when used, while gold has a long-term value, higher than USD. It is estimated that every year we only import about 3 billion USD worth of raw gold. It is worth mentioning that in reality, although the Government has not allowed gold imports, foreign currency still flows out through smuggling. Moreover, the higher the difference in gold prices, the more it encourages gold smuggling. Allowing official import and export will encourage the export of gold jewelry, helping the gold market operate normally and effectively.

In the long term, Dr. Le Xuan Nghia said that Vietnam needs to consider removing the quota-based license for the import of gold bars and raw gold. Enterprises and commercial banks should do it themselves. At the same time, it is also necessary to research and establish a national gold exchange. First, a wholesale trading floor should be established, in which enterprises are allowed to import and a number of commercial banks participate in transactions. The exchange operates publicly so it will follow international prices as the standard, the buying and selling mainly adds some costs. At that time, enterprises in need will buy to process and retail to the market. Later, we will consider moving towards establishing a gold trading floor for accounts, and at the same time consider collecting taxes like securities. When there is a wholesale trading floor and normal gold imports are allowed, the difference in gold prices in Vietnam and the world will decrease sharply. The State Bank will still monitor the total amount of imported gold as well as the amount of foreign currency spent to buy gold. China also allows many commercial banks and large domestic gold and silver trading companies to import gold for wholesale on the floor, similar to trading of goods such as rice, coffee, etc.

"When the world price is followed, there will no longer be an unreasonable difference between domestic and international prices like today. The gold market will gradually stabilize, return to normal operations and smuggling will also decrease sharply when the price difference is no longer large. At the same time, gold trading on the floor helps prevent a few large enterprises from "monopolizing" the gold market as well as helping to ensure information transparency," said Dr. Le Xuan Nghia.

World gold price hits record high

Yesterday (September 9), the world gold price increased to a new record when buying at 3,652.7 USD/ounce and selling at 3,654.7 USD/ounce. The total world gold price increased by more than 37 USD after one day. The gold price continued to maintain its upward momentum as investors increasingly believed in the possibility of the US Federal Reserve (Fed) lowering interest rates in the upcoming September meeting. Domestically, at the end of

Yesterday, SJC gold bars at Saigon Jewelry Company were bought at 133.8 million VND/tael and sold at 135.8 million VND/tael, an increase of 700,000 VND after one day. 4-number 9 gold rings were bought at 128.3 million VND and sold at 130.8 million VND, an increase of 600,000 VND.

Establishment of inspection team for enterprises and banks

The Government Office issued Document No. 8390 dated September 8 conveying the direction of Deputy Prime Minister Nguyen Hoa Binh on the recent gold market situation. Accordingly, the Deputy Prime Minister requested the Government Inspectorate to preside over and coordinate with relevant ministries and branches to establish an inspection team on September 9 to inspect the compliance with policies and laws of credit institutions and enterprises in gold trading activities.

The inspection team conducts inspections of the compliance with policies and laws of credit institutions and enterprises in gold trading activities, anti-money laundering, the creation and use of invoices and documents related to gold trading activities and other related issues; in case of detecting signs of law violations during the inspection process, the information and records will be immediately transferred to the police; the inspection results will be reported to the Prime Minister in September.

In addition, the State Bank shall promptly, resolutely, and drastically take solutions and measures to improve the efficiency and effectiveness of state management to ensure a safe, healthy, effective, and sustainable gold market, absolutely not allowing fluctuations in gold prices to affect the stability and safety of the financial and monetary markets, and macroeconomic stability; periodically report to the Prime Minister and Permanent Deputy Prime Minister Nguyen Hoa Binh on developments in the gold market before 11:00 a.m. every Friday.

Thanhnien.vn

Source: https://thanhnien.vn/xay-dung-thi-truong-vang-da-dang-minh-bach-185250909222033753.htm

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

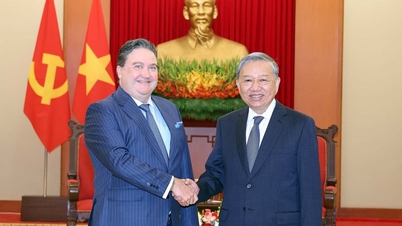

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)