The leader of the Fahasa bookstore chain predicted that the market situation this year will remain difficult, so the revenue target will only increase by 3% to VND4,000 billion, while pre-tax profit is expected to remain flat at VND70 billion.

According to the document submitted to the annual general meeting of shareholders just announced on the afternoon of March 19, the Board of Directors of Ho Chi Minh City Book Distribution Joint Stock Company (Fahasa, stock code: FHS) expects this year's revenue to increase by 3%, equivalent to an increase of more than VND 100 billion, to VND 4,000 billion. Pre-tax profit is expected to be not much different from last year, reaching VND 70 billion. The expected dividend rate is 16%, while last year it was 18%.

Fahasa’s Board of Directors forecasts that the market situation will continue to be difficult. However, the company will still invest in opening new, modern, large-scale bookstores in potential markets and renewing existing bookstores. In addition, the company said it will exploit new products to catch up with the trend of young people, promoting business in the book, stationery, school supplies, toys and gift industries.

|

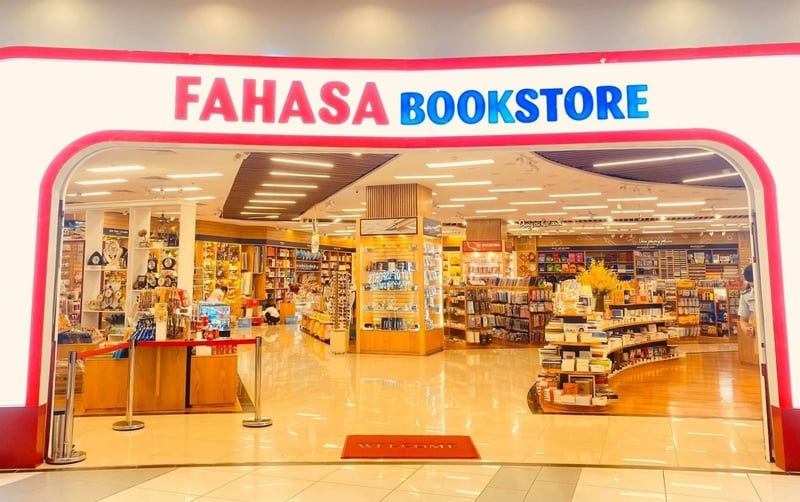

| A Fahasa bookstore. |

Last year, Fahasa recorded revenue of VND3,902 billion and pre-tax profit of VND70 billion, up 1% and 53% year-on-year, respectively. After-tax profit reached VND56.6 billion, up 55% year-on-year thanks to exploiting many new goods from domestic and foreign suppliers, organizing effective business programs, and managing operating costs well. This is the highest level since the company registered to trade on the stock exchange and publicly disclosed its business results in 2018.

According to the audited financial report, by the end of 2023, Fahasa had total assets of VND 1,419 billion, a significant increase compared to VND 1,297 billion at the beginning of the period. The company recorded liabilities at the end of the year of VND 1,216 billion, an increase of nearly VND 100 billion compared to the beginning of the year. Undistributed profit after tax at the end of the period reached approximately VND 50 billion.

Up to now, Fahasa system has 120 bookstores. The company also said that it has been investing heavily in e-commerce to suit the trend of technology application. Fahsaa e-commerce center is gradually playing an important role in the company's overall operations.

On the stock exchange, FHS shares are currently at VND30,400, but liquidity is relatively bleak. This stock has had 4 consecutive sessions without recording this order being successfully executed. The company's capitalization, calculated at current market price, is VND387 billion.

Source

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)