Coc Coc's report focused on assessing changes in user behavior, opinions, benefits and concerns after a period of practical experience with the new security measure.

According to Decision No. 2345/QD-NHNN of the State Bank, from July 1, 2024, all transactions over VND 10 million/time or over VND 20 million/day are required to be authenticated by biometrics to enhance security and protect consumers against fraud risks.

Nearly 1 month after the regulation was officially applied, to update users' views on biometric authentication in online money transfer transactions, Coc Coc conducted a large-scale online survey with users on this platform.

Hanoi and Ho Chi Minh City have the highest success rate of installation

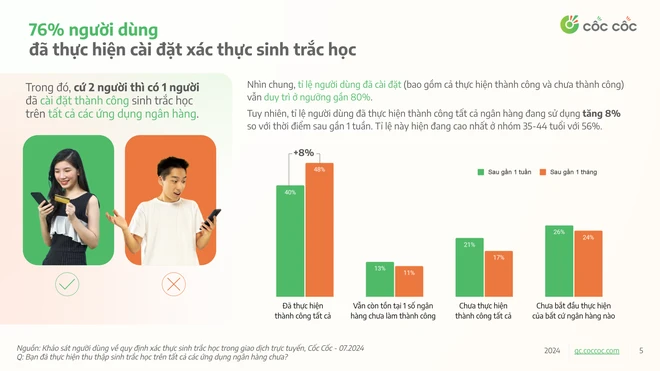

According to Coc Coc representative, 76% of surveyed users have installed biometric authentication, including both successful and unsuccessful implementation. Of which, 1 in 2 people have successfully installed biometrics on all banking applications they are using.

Overall, at the two survey points, the percentage of users who have installed the app remains at nearly 80%. However, the percentage of users who have successfully installed all the banks they are using has increased by 8% compared to the time point after nearly a week before. This rate is currently highest in the 35-44 age group at 56%.

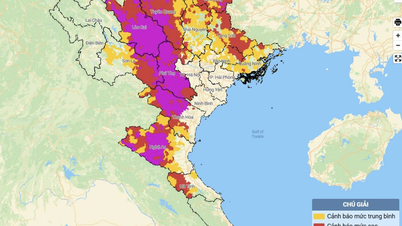

Hanoi and Ho Chi Minh City are still the two regions with the highest success rate of installing all banks in use. The Central region also quickly caught up with the highest success rate of authentication compared to the whole country with an increase of 11% compared to the time after nearly 1 week of applying the regulation.

The survey results show that the authentication experience is getting easier for the majority of users. With 45% of users rating the collection process as easy/very easy, up 7% from the previous survey. At the same time, the percentage of users finding it difficult decreased from 31% to 22%.

Users under 45 years old showed that they are adapting faster to the new regulations, with 48% finding it easy/very easy to update their biometrics, while the rate for users over 45 years old was 38%.

However, there are still some difficulties in the implementation process. For the current large-scale survey, “Difficulty in facial recognition,” “Incompatible devices” are the problems that affect the user authentication experience with increasing rates.

"Unable to read NFC," "Difficult to take a photo of ID card/read QR code," "Required to update ID card information at the bank" are problems that seem to have been gradually resolved with a lower rate than before.

How have user perceptions changed?

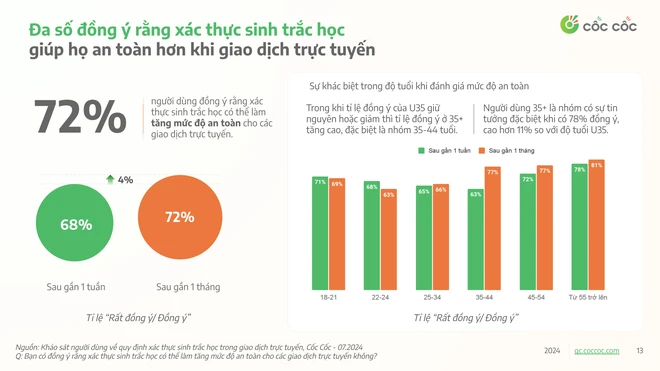

The majority of users agree that biometric authentication makes them safer when transacting online, with 72% agreeing, up 4% from the previous survey. Those over 35 are particularly confident, with 78% agreeing, 11% higher than those under 35.

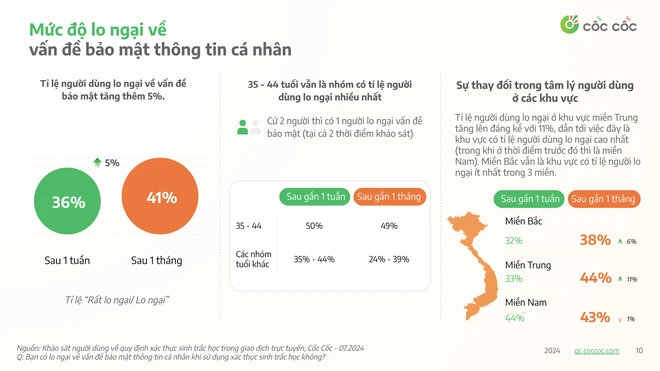

However, 41% of respondents still said they were concerned about personal information security when performing biometrics, a 5% increase compared to the previous period. Specifically, at the two survey times, the 35-44 age group was still the group with the highest percentage of users concerned, at approximately 50%.

There are also some changes in the user sentiment on this issue in different regions. The percentage of users who are concerned in the Central region has increased significantly by 11%, making this the region with the highest percentage of users who are concerned. Meanwhile, the North is still the region with the lowest percentage of users who are concerned among the three regions.

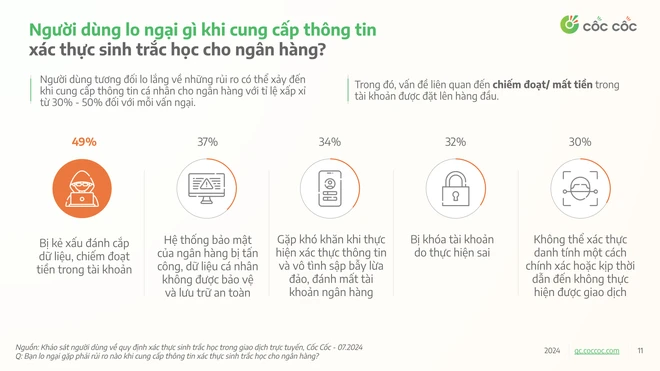

When asked about concerns about risks encountered during the biometric implementation process, users were relatively worried about the risks that could occur when providing personal information to banks, with a rate of approximately 30% - 50% for each concern.

Among them, the issue of account theft/loss is at the top of the list. Young users and women show that they are especially worried about scams that can happen during online transactions. Specifically, while only 22% of people over 45 are concerned, up to 40% of young users are concerned about this issue. This rate is 10% higher among women than men.

According to the general perception of users, safety and convenience are the biggest advantages of biometric authentication when transacting online. Quick operation and ease of use are the outstanding advantages drawn after the usage process. However, 17% of users still do not find any advantages in this security measure.

Most users evaluate the limitations of this method mainly from the experience when performing it, such as difficulty in low light, wet fingers... or time-consuming and difficult to operate.

The U25 age group is the age group that has many problems related to difficulty in using in certain conditions. Meanwhile, the 25 - 34 age group pays more attention to the time to make a transaction. The age group over 35 shows that they are more "easygoing" when the evaluation rate in all factors is much lower than the group under 35.

According to survey statistics, 51% of users have successfully authenticated all transactions made from 10 million/time or 20 million/day or more. Besides, there are still users who failed to authenticate transactions. In the past month, 1 in 3 users have encountered 1-2 failed authentications.

Most users were neutral in their assessment of transaction times when using biometric authentication. Notably, the rate of rating transactions as fast/very fast was 2.6 times higher than that of rating slow/very slow.

Up to 54% of users with transactions of 10 million/time or 20 million/day with daily frequency have good reviews about transaction speed, this rate is 1.3 times and 1.5 times higher than users with weekly and monthly transactions.

When asked about the decision to "stop all transactions if customers do not provide biometric data from January 1, 2025", 64% of users said that the above decision was necessary/very necessary, 10% of users rated it as unnecessary/very unnecessary.

It can be seen that, with a large-scale survey at the time of 1 month after applying the regulation, users have gradually become more familiar and adapted to the new security measures. The difficulties in the installation process have gradually improved.

However, in the context of online fraud cases becoming more and more sophisticated and complicated, users still have concerns and worries about the information security risks they may encounter./.

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)