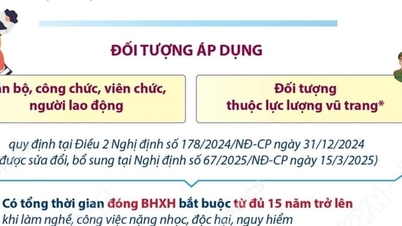

Just by paying social insurance for 15 years, workers reaching retirement age will receive a pension (Photo: Son Nguyen).

As of June 2024, Mr. C. has paid social insurance for 13 years and 1 month. From media information, Mr. C. knows that when the Law on Social Insurance (amended) takes effect (from July 1, 2025), the condition on the period of social insurance payment to receive pension will be reduced from 20 years to 15 years.

However, Mr. C. wondered: "Does this regulation apply to those who paid social insurance before July 1, 2025, or only to those who paid new contributions from July 1, 2025? In my case, do I have to pay for 20 years or only 15 years to receive pension?"

Vietnam Social Security said: "Based on the Law on Social Insurance (amended) passed by the 15th National Assembly at the 7th session, which will take effect from July 1, 2025, the regulation reduces the minimum number of years of social insurance contributions to receive a monthly pension from 20 years to 15 years. The Law on Social Insurance (amended) stipulates that employees who reach retirement age and have paid social insurance for 15 years or more are entitled to receive a monthly pension."

According to this unit, the above provisions of the Law on Social Insurance (amended) are applied to those who have participated in social insurance before the Law on Social Insurance (amended) takes effect.

"The settlement of social insurance regimes is determined according to the provisions of the law on social insurance at the time of receiving social insurance regimes, except in cases where this Law provides otherwise," said Vietnam Social Security.

Change the way pension benefits are calculated

Due to the reduction of the social insurance contribution period to 15 years, the minimum pension rate of 45% according to the Social Insurance Law 2014 is no longer suitable. Therefore, the Social Insurance Law (amended) stipulates a new way of calculating the pension level.

Accordingly, the monthly pension of employees when the Law on Social Insurance (amended) takes effect is calculated as follows.

For female workers, the monthly pension is equal to 45% of the average salary used as the basis for social insurance contributions corresponding to 15 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

For male workers, the monthly pension is equal to 45% of the average salary used as the basis for social insurance contributions corresponding to 20 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

In case male employees have paid social insurance for 15 years but less than 20 years, the monthly pension is equal to 40% of the average salary used as the basis for social insurance payment corresponding to 15 years of social insurance payment, then for each additional year of payment, an additional 1% is calculated.

Source: https://dantri.com.vn/an-sinh/quy-dinh-dong-bhxh-15-nam-duoc-huong-luong-huu-ap-dung-cho-ai-20240713165515333.htm

Comment (0)