What is a recurring deposit?

A term deposit (also known as a term deposit) is a bank deposit product in which the depositor can only withdraw money after a certain period agreed upon with the deposit-receiving institution.

When choosing this form of deposit, the customer will own a deposit contract which is a legal document proving the customer's deposit at that credit institution. This deposit contract is a type of valuable paper, the owner can mortgage or pledge to borrow capital from the issuing bank or other credit institutions.

What is a recurring deposit?

Term savings deposits are also known as term savings deposits. This is an individual's money deposited into a bank savings account for a predetermined period of time, confirmed on the savings book and entitled to interest according to the regulations of the receiving bank and insured by the law.

Customers can deposit savings in VND, USD, Euro with a minimum value of 500,000 VND, 100 USD, 100 EUR. Interest is paid periodically monthly, quarterly or at the end of the term depending on the agreement between the two parties. And it is worth noting that when withdrawing the principal before the maturity date, customers will only receive non-term interest.

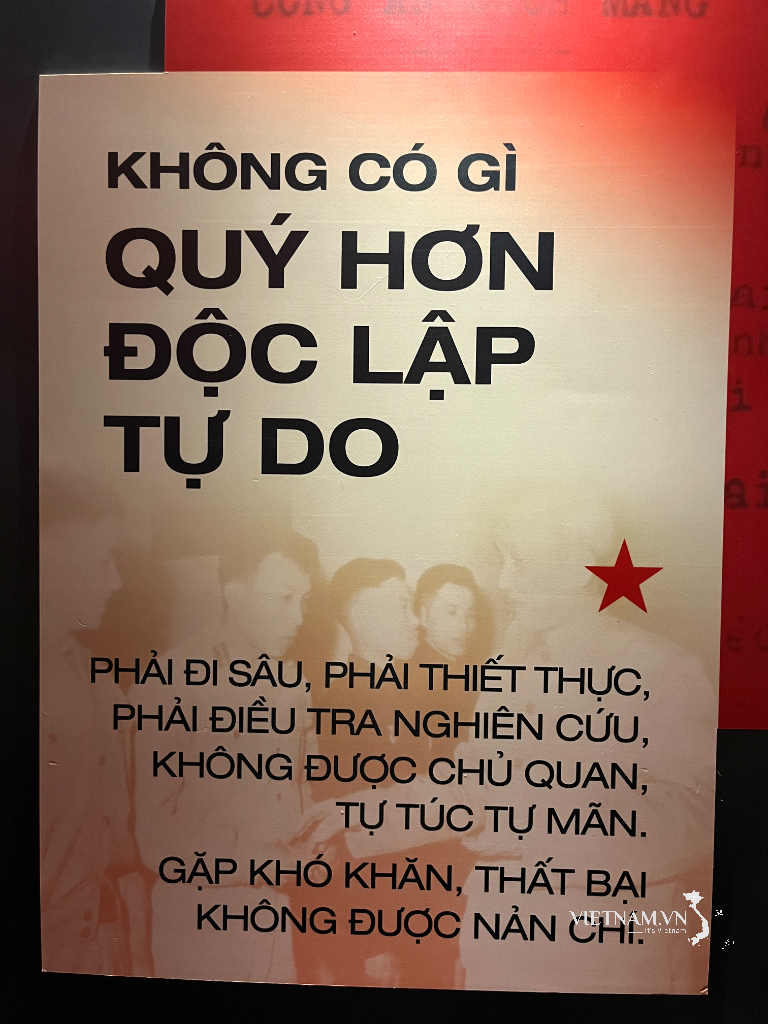

Illustration photo

Compare term deposits and term savings deposits

Alike

Term deposits and term savings deposits are similar in features, deposit types, interest payment methods, interest calculation bases and withdrawals.

- Features: Deposit, withdraw cash and transfer money.

- Deposit type: VND and foreign currencies

- Interest payment method: Prepayment/Postpayment/Periodic

- Interest calculation basis: Term interest rate

- Withdrawal: Can be withdrawn before maturity

Different

Periodic deposits are aimed at individuals or organizations. When making periodic deposits, customers will receive a deposit contract and be able to mortgage or pledge to borrow capital from the deposit bank or other credit institutions.

For periodic savings deposits, individual customers can open a card or savings book, and can use the card or savings book to borrow capital from the bank where the deposit is made.

Minh Huong (synthesis)

Source

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)