In early September, the story of giving gifts to everyone on the occasion of the 80th anniversary of the August Revolution and National Day September 2nd with the amount of 100,000 VND became a topic mentioned everywhere. Tens of millions of people experienced for the first time the digital public service, linking bank accounts with social security on VNeID.

This was also the content that was hotly discussed at the Seminar “Opportunities to rise from digital transformation: Pioneering stories from VNeID application and the Banking and Finance industry” on September 9. From that story and the successes in digital transformation of the banking industry, experts, bank leaders, and businesses looked to the future of a prosperous digital nation E-Vietnam.

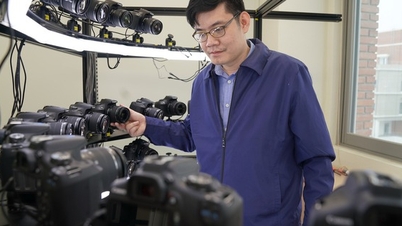

TPBank CEO Nguyen Hung |

TPBank is one of the pioneering banks accompanying the Government in the program of giving gifts of 100,000 VND on the occasion of National Day, even giving an additional 100,000 VND to people who successfully link their social security account on VNeID with their TPBank account.

According to CEO Nguyen Hung, this is not a business program, but a thank you on a special occasion. “We have no intention of doing any business in this program. On the occasion of National Day, the bank just wants to send a small gift to customers,” he shared. He also said that the large number of customers registering shows the strong spread.

According to Mr. Hung, Vietnam currently owns a huge payment system through banks. While previously the number of people owning bank accounts was limited, now 86% of adults have accounts, helping the implementation to be quick.

In particular, all payment transactions are currently operating free of charge for the people. “In fact, there are few countries like ours where all payment transactions are free. Meanwhile, in Europe or America, transaction fees are quite high. This is a great effort of the entire banking industry: maintaining a huge, free payment system for the people, even though we do not directly profit from this activity,” said Mr. Hung.

Choosing the right trend in the challenge

According to Mr. Hung, currently the majority of TPBank's customer transactions are on digital channels, with a rate of up to 98%. The customer base has reached more than 14 million, making it one of the banks with the largest customer base in Vietnam.

It is worth mentioning that before becoming one of the leading banks in digitalization, TPBank was a weak bank, subject to mandatory restructuring. In 2011, TPBank was at the bottom of the list of Vietnamese commercial banks. From that position to rise to the group of 10-12 leading banks as it is today was a difficult journey.

Mr. Nguyen Hung said that if TPBank only competed with the traditional model with the banks that had gone before, it would have almost no chance, especially when the State restricted the expansion of branches. Therefore, right from the restructuring, TPBank's leadership chose the only path: strongly developing digital channels - where the bank is not limited in serving customers by space and time.

“It can be said that in difficulty comes wisdom. In challenging circumstances, TPBank had the only choice, and that choice was right on trend,” Mr. Hung acknowledged.

Thanks to that, despite the small number of physical branches, TPBank still attracts a large number of customers. The bank is a pioneer in implementing the 24/7 automatic branch model nationwide, which has been approved for testing by the State Bank. To date, there have been about 400-500 LiveBank automatic transaction points effectively replacing traditional branches. This is a major turning point, both saving costs and bringing a convenient experience to customers.

From E-Bank to E-Vietnam aspiration

Not stopping at digital banking, TPBank aims to contribute to building E-Vietnam. VNeID and population database help eKYC to be almost absolutely accurate, prevent fraud, and promote cashless payments.

Mr. Nguyen Hung believes that E-Vietnam is not a distant vision, but can become a reality within this decade. He believes that the Party and Government's determination to reform has created a foundation for the country to make a breakthrough. VNeID is a clear demonstration of the practical benefits that digitalization brings.

In particular, TPBank CEO emphasized: “In the end, the real needs of the people are the key factor determining the success of digital transformation. It is the practical, small daily benefits that will create usage habits, then gradually spread into big changes.”

Source: https://baodautu.vn/tpbank---tu-lua-chon-so-hoa-trong-kho-khan-den-khat-vong-e-vietnam-d383872.html

![[Photo] Prime Minister Pham Minh Chinh attends the groundbreaking ceremony of two key projects in Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/6adba56d5d94403093a074ac6496ec9d)

Comment (0)