Opening the trading session on the morning of July 8, Asia- Pacific stock markets were all covered in green, despite the prevailing cautious sentiment after US President Donald Trump announced high tariffs on imported goods from 14 countries, including many major partners in Asia.

According to Reuters statistics, on July 7, US President Donald Trump sent tax notice letters to leaders of 14 countries including: Tunisia (25%), Indonesia (32%), Bosnia (30%), Bangladesh (35%), Serbia (35%), Cambodia (36%), Thailand (36%), Japan (25%), South Korea (25%), Malaysia (25%), Kazakhstan (25%), South Africa (30%), Laos (40%), Myanmar (40%).

The White House plans to send additional letters to other countries in the coming days.

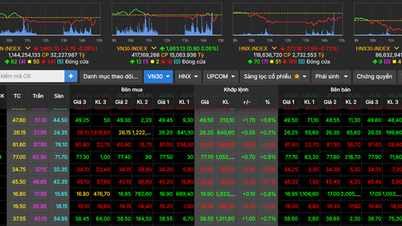

Asian stock indexes (Source: CNBC).

Several other countries in the Asia- Pacific region are also on the list of tax increases, including Indonesia with a special consumption tax rate of 32%, Bangladesh 35%, while Cambodia and Thailand are both subject to a rate of 36%. Notably, imported goods from Laos and Myanmar will face the highest tax rate of up to 40%.

However, regional markets remained in the green, supported by expectations that the tariffs may not last long. In Japan, the Nikkei 225 index rose 0.18%, while the Topix was almost flat. In South Korea, the Kospi index rose 1.01%, while the Kosdaq index was little changed.

In China, the CSI 300 index rose 0.2%, and Hong Kong's Hang Seng edged up 0.18%. Meanwhile, Australia's S&P/ASX 200 index was almost flat as the market awaited a policy decision from the Reserve Bank of Australia, which is expected to cut interest rates by 25 basis points (0.25%) to 3.6%.

In contrast to the positive developments in Asia, US stocks plunged in the first trading session of the week after Mr. Trump announced a new tariff plan, causing all three major indexes on Wall Street to record their sharpest decline since mid-June.

The Dow Jones Industrial Average fell 422.17 points, or 0.94%, to 44,406.36. The S&P 500 fell 0.79% to 6,229.98, while the Nasdaq Composite dropped 0.92% to close at 20,412.52.

The US market was also under pressure from Tesla CEO Elon Musk's announcement of a new political party called the "America Party", increasing political tensions with Mr. Trump. Tesla shares accordingly plunged 6.8%, the biggest one-day drop since June 5 and also the lowest closing level in more than a month.

Analysts say the new wave of tariffs is making investors cautious again after a series of euphoric sessions. Both the Nasdaq and the S&P 500 hit consecutive record highs last week, helped by positive employment data.

However, according to Ms. Emily Roland, co-chief investment officer at Manulife John Hancock (Boston), the market is facing the risk of tax policy returning to the center of attention, causing the excitement to subside.

Investors are closely watching the next moves of Mr. Trump, who confirmed that he will announce more new tariffs on July 9 and threatened to impose an additional 10% tax on countries that are considered to support the "anti-American" policy of the BRICS group including Brazil, Russia, India, China and South Africa.

The new wave of taxes also raises concerns that inflation will escalate again, making it difficult for the US Federal Reserve (Fed) to ease monetary policy.

Minutes from the Fed's June policy meeting, due for release on July 9 (US time), will provide further clues on the direction of interest rates in the coming time. According to the CME Group's FedWatch tool, the probability of the Fed keeping interest rates unchanged in July is currently at 95%, while expectations for a rate cut in September are around 60%.

Trading volume on US exchanges reached 16.5 billion shares, lower than the average of the last 20 sessions. Declining stocks outnumbered advancing stocks by a ratio of 3.44:1 on the New York Stock Exchange. On the Nasdaq, the ratio was 2.74:1.

Of the 11 major sectors in the S&P 500, nine declined, led by consumer discretionary and energy. Defensive sectors such as utilities and consumer staples, on the other hand, recorded slight gains. A rare bright spot was WNS Holdings, which surged 14.3% after news that it was being acquired by French group Capgemini for $3.3 billion.

Mr Trump's tough trade policies are casting a shadow over global markets and will continue to be a major unknown for investors in the coming weeks.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-my-lao-doc-chau-a-tang-vot-sau-thu-ap-thue-moi-cua-ong-trump-20250708091709113.htm

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)