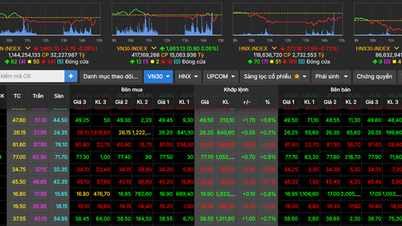

At the beginning of this morning's trading session (September 5), VN-Index easily conquered the 1,700-point mark - the highest ever. At 9:47, the index increased by 5.5 points to 1,701.66 points. Green dominated both floors, with HoSE liquidity exceeding VND7,400 billion.

The VN30 large-cap stocks group mostly moved in green, but still could not conquer the resistance level of 1,900 points.

Banking stocks such as TCB,ACB , MBB, VPB still have a strong impact, contributing to the leading role of the index. In addition, there are some other large-cap stocks such as VIC, SSI, MSN, VJC...

Stocks surpass 1,700 points (Illustration: Dang Duc).

In just the first minutes of trading,SHB (Saigon - Hanoi) shares recorded a large trading volume of over 21.5 million units. Next was HPG (Hoa Phat) with nearly 12 million units.

Steel stocks are divided this morning after yesterday's exciting trading. Some codes are losing points like HPG, HSG; some are flat and a few others are slightly increasing.

Pillar stocks related to the " Vingroup family" increased simultaneously, such as VIC, VRE, VPL, except for VHM, which decreased by nearly 2%.

The stock market is excited in the context of the upcoming FTSE review to upgrade from frontier market to emerging market on October 7. Vietnam has met 7/9 necessary criteria, the remaining two criteria on payment cycle and failed transaction costs have also made significant progress.

HSBC has just given an estimate in an optimistic scenario that FTSE's upgrade could help Vietnamese stocks attract a maximum of 10.4 billion USD from foreign capital flows.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-vuot-dinh-1700-diem-20250905095415773.htm

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)