Tensions in the Middle East cause oil prices to increase sharply

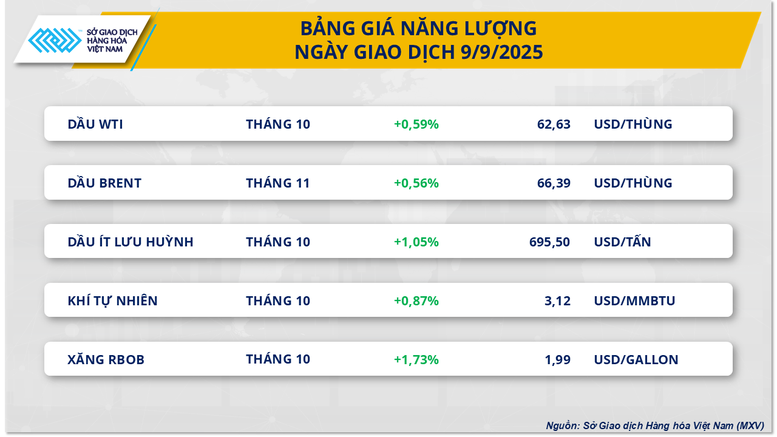

According to MXV, the energy market in yesterday's trading session recorded overwhelming buying power, when all 5 commodities in the group increased in price. Of which, Brent oil price closed up 0.56%, to 66.39 USD/barrel; WTI oil price also increased 0.59%, reaching 62.63 USD/barrel.

Market developments were boosted after tensions suddenly broke out between the Israeli army and Hamas forces in the capital Doha (Qatar), causing world oil prices to surge sharply - at times exceeding 2%. However, the situation quickly calmed down, causing oil prices to narrow significantly towards the end of the session.

The rise in oil prices continued to weaken for the rest of the session after the US side made a commitment to Doha that no similar move would take place on Qatari territory. According to investors, the geopolitical environment in the Middle East region remains stable for now, with no new unusual risk factors that could lead to the risk of supply disruption from this region.

In addition, world oil prices also received support from expectations that the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed) will decide to cut interest rates in September. These expectations were further reinforced after new, not-so-positive information about the labor market of the world's largest economy .

According to the preliminary report of the annual standard revision of the US Bureau of Labor Statistics (BLS), the actual number of jobs created in the 12 months to March this year was about 911,000 lower than the initial estimates. Although this is a potential factor that puts downward pressure on oil prices, investors still expect that the Fed will soon lower the base interest rate to promote economic growth, thereby increasing the demand for energy consumption in the US in the coming time.

In another development, the US natural gas market continued to recover in price during yesterday's trading session. At the end of the session, this commodity on the NYMEX floor increased by 0.87%, stopping at 3.12 USD/MMBtu - the highest level since the end of July.

The price rally is underpinned not only by forecasts of prolonged hot weather but also by the US Energy Information Administration (EIA) Short-Term Energy Outlook, which forecasts natural gas prices at the Henry Hub to rise to $3.70/MMBtu in the fourth quarter of 2025 and $4.30/MMBtu in 2026, largely due to increased gas exports from the US.

Supply pressure supports cocoa prices

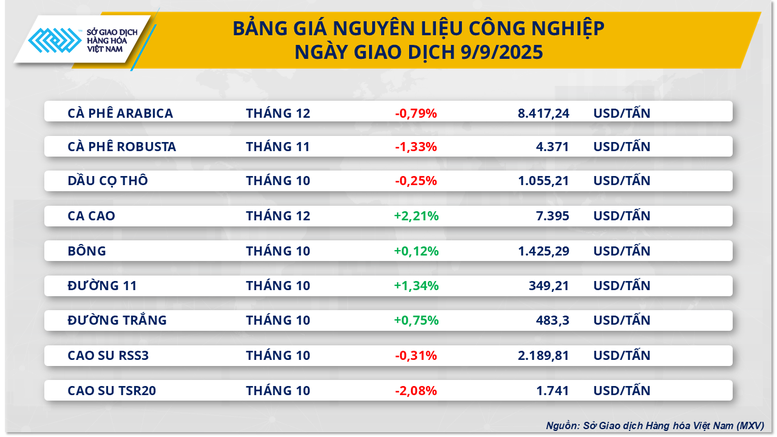

Not outside the general market trend, the industrial raw material group continued to maintain positive purchasing power on a number of key commodities. In particular, cocoa prices increased by more than 2.2%, reaching 7,395 USD/ton. According to MXV, tight supply was a factor supporting cocoa prices in yesterday's trading session.

Cocoa supply figures from Ivory Coast have yet to show positive signs, with cocoa arrivals in the week ending September 7 reaching only 7,000 tonnes, down from 9,000 tonnes last week and 12,000 tonnes in the same period last year. Cumulatively, since the beginning of the crop year (from October 1), cocoa arrivals have reached 1.68 million tonnes, down 2.32% from 1.72 million tonnes in the same period last year, and the lowest level in at least six years.

Meanwhile, Ghana, the world’s second-largest cocoa producer, is facing its weakest crop in more than two decades, with production estimated at just 530,000 tonnes in 2024-25 due to disease and aging cocoa trees that have reduced yield.

Additionally, a sharp drop in cocoa inventories also contributed to supporting prices of this commodity in yesterday's session. On the weather side, drought in Ivory Coast and Ghana is gradually raising concerns about negative impacts on the upcoming cocoa crop.

However, concerns over low demand for cocoa in the market have created a drag on the price increase of this commodity.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-sac-xanh-bao-phu-102250910085343457.htm

Comment (0)