Illustration photo using AI technology - Made by: TUAN ANH

In particular, salaried workers are the group with the most concerns. Why?

Ministry of Finance : "Many people will not have to pay taxes"

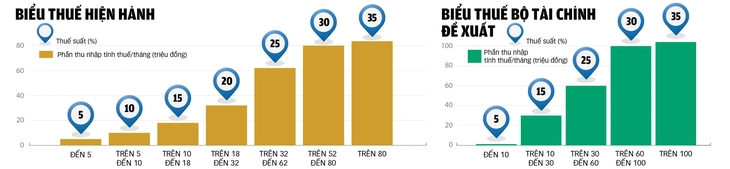

In the draft law, the Ministry of Finance affirmed that the tax rate will be reduced from 7 to 5 tax rates, and that when the family deduction level is increased and some medical, education and training expenses will be deducted, many people will significantly reduce the amount of tax they have to pay, and many people will even no longer be subject to personal income tax.

Specifically, the Ministry of Finance proposed two options for tax rates. Both have five levels, with level 1 applied to taxable income below VND10 million/month. In option 1, the highest tax rate of 35% applies to income from VND80 million and above; and in option 2, the 35% rate applies from the threshold of VND100 million.

The Ministry of Finance calculates that with option 1, people with taxable income of 10 million VND/month will have their tax reduced by 250,000 VND; income of 30 million VND will be reduced by 850,000 VND; income of 80 million VND will be reduced by 650,000 VND. With option 2, people with taxable income up to 50 million VND/month will have their tax reduced similarly to option 1, while higher income groups will have their tax reduced more strongly.

"Adjusting tax rates according to the two options mentioned above and increasing family deductions, adding deductions for health , education... will reduce the amount of personal income tax payable. In particular, individuals with average and low incomes will not have to pay personal income tax" - Ministry of Finance assessed.

The Ministry of Finance cited an example: an individual with one dependent, with income from salary and wages of 20 million VND/month, currently paying tax of 125,000 VND/month, but when implementing family deductions and tax schedule according to option 2, this individual will no longer have to pay tax. Therefore, the Ministry of Finance proposed to implement according to option 2. It is estimated that the budget will reduce revenue by about 29,700 billion VND/year.

With all costs increasing, salaried workers only spend on the most essential needs - Photo: BE HIEU

Tax policy needs to be realistic

Ms. NTS, market development director of a company specializing in importing medical equipment (Hanoi), said that last year she paid more than 144 million VND in taxes. Because she only has one dependent, her taxable income is increased from level 1 to level 6 and the highest tax rate is 30%.

"I really feel a lot of pressure, the tax payable is very high, accounting for 16% of income, while businesses pay tax at 20% and are allowed to deduct expenses before calculating tax" - Ms. NTS said and hoped that with the amendment of the tax table, the family deduction level would be increased and expenses including home loan interest would be deducted. Thus, the tax burden could be lightened.

Meanwhile, Mr. Nguyen Van Hau (Ha Dong, Hanoi) hopes that there will be more deductions such as interest on home loans, in addition to education and medical expenses for dependents. Because with real estate prices reaching hundreds of millions of VND/m2, salaried workers who want to own a house must borrow from many sources, including banks. Therefore, interest on home loans needs to be deducted before calculating taxes.

On the other hand, Mr. Hau is concerned that his child's tuition fees have been exempted since this school year. So what educational expenses will be deducted and how much needs to be carefully guided so that the policy is truly meaningful to the people.

What about dependents who are parents and those who are directly supported by taxpayers? The regulation that an income of no more than 1 million VND/month is considered a dependent, applied for 17 years now, is making it difficult for people. This 1 million VND level is currently lower than the average income at the poverty line in rural areas. If divided into 30 days in a month, how will people spend?

"My mother has a monthly allowance of 1.3 million VND, so for many years I have not been able to get any deductions for her, even though the monthly medicine cost is many times higher than this amount. I really hope that there will be a tax policy that is close to real conditions, and not let taxpayers get stuck because of outdated policies, which even make them frustrated," Mr. Hau suggested.

Source: Ministry of Finance - Compiled by Le Thanh - Graphics: TUAN ANH

The highest taxable income should be over 200 million VND.

Commenting on the tax table proposed by the Ministry of Finance, Dr. Nguyen Ngoc Tu, a tax expert, suggested that it should be completely renewed. Specifically, the gap between tax brackets should be widened, which means raising the taxable income of each bracket. Taxable income at the highest bracket should be over 200 million VND.

Mr. Tu analyzed: The policy should not continue to maintain the outdated regulations for many years, because the taxable income level of 80 million VND has been applied since this law was enacted (in 2007), which is more than 17 years ago. Now the proposal to raise it to 100 million VND does not have much innovation, while prices and people's income have increased many times.

Mr. Nguyen Van Duoc, General Director of Trong Tin Accounting and Tax Consulting Company Limited, said that the jump in levels 1 and 2 in the progressive tax schedule is not reasonable, so it is necessary to expand and remove level 3 with a tax rate of 25% to reduce pressure on salaried workers in the average and good segments.

With the highest tax rate of 35%, according to Mr. Duoc, it would be more reasonable to apply it to taxable income from 120 - 150 million VND/month than the current proposed rate of 80 - 100 million VND/month.

Mr. Do Quoc Tuan - former deputy head of the propaganda and support department of the Ho Chi Minh City Tax Department (now Ho Chi Minh City Tax) - also proposed to spread out the taxable income levels in the first tax tables in the progressive tax table to help salaried taxpayers save a little.

Giving opinions on the draft Law on Personal Income Tax (replacement) organized by the Ho Chi Minh City Tax Consultants and Agents Association (HTCAA), this unit said that most of the recommendations suggested that the highest tax rate should be reduced to 30%. Thus, the new policy attracts and retains talents, experts, and scientists with high professional qualifications. At the same time, a reasonable personal income tax rate also encourages and motivates workers to get rich legitimately.

Regarding tax rates, experts agree with 5 tax rates and also agree with option 2, but should adjust the gap wider at rates 1 and 2, increasing by 10 - 15 million VND compared to the draft.

Salaried workers are paying 65-70% of personal income tax.

According to the Ministry of Finance, despite the COVID-19 pandemic and the economic recovery period, personal income tax has increased steadily, with each year higher than the previous year. If in 2011 the revenue reached VND 38,469 billion, by 2024 it had increased to VND 186,300 billion, more than 4.8 times after 13 years and this revenue accounts for more than 9% of the total budget revenue.

The main source of income comes from salaries and wages, accounting for 65-70% of total personal income. In particular, the group paying taxes at level 7, although only about 2-5% of the total number of taxpayers, contributes up to half of the taxes from salaries and wages. For example, in 2023, out of more than 3.8 million individuals paying taxes from salaries and wages with 73,500 billion VND, there are 61,677 people paying at level 7 with more than 38,000 billion VND.

It is worth noting that the number of people paying taxes from salaries and wages has increased very rapidly. In 2020, there were only 2.31 million people, and in 2021, it nearly doubled to 4.5 million people. In 2022, this number continued to increase to 4.6 million people. By 2023, despite the impact of the COVID-19 pandemic, the whole country still has more than 3.8 million wage earners who have to pay personal income tax.

Family deduction level soon increased to 18 million VND

In the draft law, the family deduction level and guidance on deducting medical, education and training expenses are assigned to the Government to regulate in accordance with the socio-economic situation. Previously, according to comments from many ministries and branches, the deduction level for dependents was 17-18 million VND/month and the deduction level for taxpayers was 8 million VND/month.

Mr. Do Quoc Tuan (former deputy head of the propaganda and support department of the former Ho Chi Minh City Tax Department) said that the current deduction level is very inappropriate, not only for salaried employees but also for dependents. Accordingly, the deduction level for dependents is currently only 40% of that of taxpayers. Specifically, while taxpayers are currently deducted 11 million VND/month, dependents are deducted 4.4 million VND/month.

"The question is why is the 40% rate set? In reality, raising a child can cost more than the taxpayer because of a series of expenses such as tuition, food, entertainment, illness, etc. Therefore, I propose raising the deduction for dependents to the same level as the employee himself or to at least 60%, because the 40% rate is too low and unreasonable with real life," Mr. Quoc Tuan argued.

Mr. Tuan also assessed that with the plan to increase the family deduction level and amend the progressive tax table in the draft Law on Personal Income Tax (replacement), low-income workers will not see much reduction, while high-income workers will see "a little reduction".

Meanwhile, Mr. Nguyen Thai Son - former head of the personal income tax department of the Ho Chi Minh City Tax Department (now Ho Chi Minh City Tax) - commented that salaried workers are being "oppressed".

Mr. Son analyzed: In essence, family deductions are essential expenses to meet basic survival needs such as food, accommodation, travel, study, medical treatment... for workers to live and contribute. Income after family deductions is subject to personal income tax. This is similar to businesses being able to deduct reasonable and valid expenses before paying corporate income tax.

According to the Law on Value Added Tax, effective from July 1, 2025, individuals engaged in production and business with a revenue threshold of less than VND 200 million/year (equivalent to VND 16.6 million/month) are exempt from tax. The new family deduction level that the Ministry of Finance proposed to increase for salaried employees according to the highest option of only VND 15.5 million/month for taxpayers and VND 6.2 million/month for dependents, according to Mr. Son, is not satisfactory.

The tax rate that wage earners are subject to under the progressive tax schedule is also unreasonable when compared with the corporate income tax rate.

The corporate income tax rate applicable to businesses with revenue under 3 billion VND/year is only 15%. Businesses with revenue from 3 billion to under 50 billion VND also only have to pay tax at the rate of 17% after deducting all reasonable expenses.

Meanwhile, for workers with an income of 3 billion VND/year (equivalent to 250 million VND/month), if they choose the family deduction according to option 2, the tax rate on income will be up to 28%.

It is even more "unfair" when individual workers are only given a small family deduction, the rest of their income is subject to tax. Mr. Son also recommended that the Ministry of Finance study and design a maximum tax rate of 25% to ease the burden on the people.

At the conference to collect comments on the draft Law on Personal Income Tax (replacement) organized by the Ho Chi Minh City Tax Consultants and Agents Association in August, the majority of opinions proposed to increase the family deduction for taxpayers to about 18 million VND/person/month and for dependents to 7.5 million VND/person/month.

Some opinions suggest that dependents should be counted at 100% as taxpayers because the living, education, and medical expenses of dependents are the same as those of taxpayers.

Delegate TRAN KHANH THU (Hung Yen):

Need to reassess tax threshold

Reducing the tax system to 5 levels is a step forward in reforming the tax system. Widening the tax gap, especially at the income threshold of 30-100 million VND/month, also creates "breathing space" for workers to work hard without worrying about being taxed too early.

This is also a more suitable approach in the context of Vietnam needing to encourage the expansion of the middle class, thereby increasing the consumption and accumulation power of the economy.

However, the tax threshold needs to be re-evaluated, because the current level of 10 million VND/month does not keep up with the cost of living in large cities. According to calculations, a family with two children studying must have an income of 25-30 million VND/month to cover expenses.

Therefore, it is possible to consider raising the starting threshold to 20 million VND/month to reduce tax pressure on low-income people, while considering a mechanism for periodic adjustment according to the consumer price index (CPI).

Along with that, the Ministry of Home Affairs has said that it will report to the Politburo in September on policy issues related to allowances and salaries. Therefore, it is necessary to calculate and adjust accordingly.

In addition, some experts also suggested that the taxable income at 35% should be raised to 120 - 150 million VND. It is necessary to expand the tax rate more strongly at levels 1 and 2 to reduce the tax burden for the middle-income group.

At the same time, it is possible to consider removing the 25% tax rate and adjusting it in the direction of "jumping" from 20% to 30%. The drafting agency should also fully consider these opinions.

Another important issue is the law's enforcement, as proposed by the Ministry of Finance, the law will take effect from July 1, 2026. Why not stipulate that this law will take effect from January 1, 2026? Because according to the program, the National Assembly will consider and approve it right at the opening session next October. Taking effect from the beginning of the year will help both tax authorities and taxpayers.

Delegate NGUYEN QUANG HUAN (HCMC):

Should be applied from the beginning of 2026

The starting level of 10 million VND/month in the tax schedule is a bit low, not suitable for the income and living standards of people in big cities like Hanoi and Ho Chi Minh City today. Therefore, I propose to raise the starting level of tax, maybe double it to 20 million VND/month, which would be more suitable. At the same time, this tax schedule should also take effect from the beginning of 2026 to ensure convenience for tax calculation and payment instead of the proposed deadline of July 1, 2026 as the bill.

I have also repeatedly expressed my opinion that the draft revised Law on Personal Income Tax, which was drafted by the Ministry of Finance and proposed that the Government regulate the family deduction level, is correct. This proposal is completely appropriate, and at the same time ensures flexibility and proactive adjustment to suit the reality and requirements of the country's socio-economic development in each period.

This also demonstrates the spirit of innovation in law-making and strong decentralization today. In particular, the Government should be given the initiative to decide on issues related to socio-economic management, then report back to the National Assembly and the National Assembly Standing Committee. At the same time, it should avoid the situation where the Government has to ask for opinions when needed.

How do Southeast Asian countries collect personal income tax?

Personal income tax in Singapore is highest at 24% - Illustration photo by AFP

Personal income tax in ASEAN countries is often built on a progressive tax mechanism like Vietnam, meaning that higher income groups will be subject to higher tax rates. Some countries apply simple or flat tax rates, but many countries maintain complex and multi-layered tax systems.

Brunei, an oil-rich and small-population nation, stands out as the only ASEAN country with no personal income tax, for both residents and non-residents, making it an attractive destination for high net worth individuals and expatriates.

Personal income tax in the Philippines is as high as 35%, compared to just 24% in Singapore. In Thailand, it is also 35% but with more exemptions. Cambodia and Laos have simplified tax schemes, with rates ranging from 20% to 25%.

As of the end of 2024, Indonesia applies a tax system of 5-35%, ranging from income levels per person from less than 60 million rupiah (5%) to over 5 billion rupiah (35%). In particular, permanent residents, including Indonesian citizens, are subject to this calculation for income regardless of whether it is domestic or foreign. Non-permanent residents are only required to pay tax on the income earned in Indonesia according to the above levels.

Countries also take into account deductions and subsidies when collecting personal income tax. Among them, Singapore is famous for its many generous tax reduction and deduction programs.

In an article in The Manila Times of the Philippines last August, author Ray G. Talimio Jr. argued that the country is missing out on many opportunities because of its top personal income tax rate in Southeast Asia. One of the consequences is that foreign direct investment (FDI) in the Philippines has decreased because high income and dividend taxes reduce after-tax profits, discouraging foreign investors because they have more favorable options in the ASEAN region.

According to the author, with its low tax and transparent regime, Singapore continues to be the top FDI recipient in Southeast Asia. The UNCTAD World Investment Report 2024 shows that Singapore accounts for more than 30% of ASEAN’s total FDI inflows, while the Philippines lags behind with less than 5%. This not only reflects investor sentiment but also leads to job losses and slower technology transfer.

According to the author, although the government needs revenue to finance social services and infrastructure, high and inefficient taxation often leads to tax evasion, loopholes and administrative burdens. For example, the 12% value added tax is poorly enforced at the informal sector level.

“Taxation is not only a domestic fiscal tool, but also a powerful signal to the global market. The Philippines needs to rethink its tax policy, not simply for tax enforcement or collection, but also as a strategic lever for growth, competitiveness and social development,” argues author Ray G. Talimio Jr.

Source: https://tuoitre.vn/thue-thu-nhap-ca-nhan-nguoi-lam-cong-an-luong-con-nhieu-ban-khoan-2025090808191819.htm

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)