(Dan Tri) - A series of banks have increased interest rates to attract depositors before Tet. Since the beginning of the year, 10 banks have adjusted their savings interest rates.

Since the beginning of January, 10 banks have announced new interest rates. Compared to the previous survey by Dan Tri reporters, in addition to small-scale banks, this interest rate adjustment also has the participation of large-cap banks.

Specifically, 8 banks increased their deposit interest rates, including Agribank , Bac A Bank, NCB, MBV (formerly OceanBank), ABBank, Eximbank, VietBank and KienlongBank. KienlongBank and Eximbank even increased their interest rates twice since the beginning of the month.

Interest rates increased at the beginning of the year

According to the new interest rate schedule at Agribank, the interest rate for short-term deposits of 3-5 months and 6-9 months reached 3%/year and 3.7%/year, respectively, up 0.1 percentage points/year. On the contrary, the interest rate for long-term deposits of 12-36 months decreased by 0.1 percentage points/year, down to 4.7-4.8%/year. The bank's online savings channel has higher interest rates.

Small-scale banks also adjusted savings interest rates. At NCB, 1-5 month term deposits at this bank increased by 0.2 percentage points/year compared to the interest rate schedule at the end of 2024, reaching 4.1-4.5%/year. In the opposite direction, 12-60 month term deposits decreased by 0.1 percentage points/year, down to 5.7%/year.

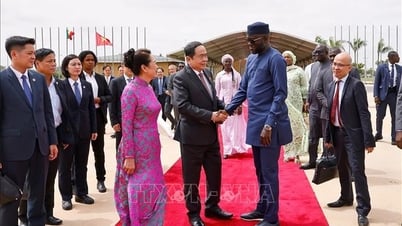

10 banks adjusted interest rates since the beginning of the year (Photo: Tien Tuan).

MBV increased deposit interest rates for short terms by 0.2 percentage points per year and for long terms by 0.1 percentage points per year. Depositors with 1-5 months deposit interest rates receive 4.7% per year, the highest in the market, those with 6-15 months deposit rates are around 5.5-5.8% per year and those with over 18 months deposit rates receive 6.1% per year.

Two banks have adjusted interest rates twice since the beginning of the month: KienlongBank and Eximbank. At KienlongBank, the 12-month term has increased by 0.2 percentage points per year, to 6.1% per year. The 12-17 month terms have increased by 0.35 percentage points per year, to 6.1% per year. Previously, on January 9, this bank increased interest rates for all 1-36 month terms, with an increase of 0.1-0.4 percentage points per year.

At Eximbank, interest rates increased by 0.1% to 0.8%, with the highest rate being 6.7% per year, applied to 18-month term deposits. Previously, this bank had increased interest rates.

*Interest rate table of some banks (unit: %/year)

| Bank | 1 month | 3 months | 6 months | 12 months |

| Agribank | 2.4 | 3 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 4.7 |

| VietinBank | 2 | 2.3 | 3.3 | 4.7 |

| Vietcombank | 1.6 | 1.9 | 2.9 | 4.6 |

| ABBank | 3.2 | 3.6 | 5.8 | 5.9 |

| ACB | 3.1 | 3.5 | 4.2 | 4.9 |

| Eximbank | 4 | 4.3 | 5.3 | 5.5 |

| LPBank | 3.6 | 3.9 | 5.1 | 5.5 |

| MB | 3.7 | 4 | 4.6 | 5.1 |

| VPBank | 3.8 | 4 | 5 | 5.5 |

| Sacombank | 3.3 | 3.6 | 4.9 | 5.4 |

Special high interest rates for customers depositing hundreds of billions of dong

PVcomBank, ACB, HDBank, DongA Bank, MSB, LPBank... are banks that maintain special interest rates with levels that are much higher than the online mobilization interest rate table. However, the special interest rate only applies to customers with deposit balances from hundreds to thousands of billions of VND.

Customers have the opportunity to receive interest rates up to 9%/year with deposits of 2,000 billion VND (Photo: Tien Tuan).

At PVcomBank, customers can receive an interest rate of 9%/year if they deposit an amount of VND2,000 billion or more with a term of 12 and 13 months.

At HDBank, the special interest rates applied for 12 and 13 month terms are 7.7% and 8.1%/year respectively. Individual customers receive interest at the end of the term and deposit a minimum amount of VND500 billion to receive this interest rate.

At MSB, customers depositing from 500 billion VND will receive the highest deposit interest rate of 8%/year, 13-month term and 7%/year, 12-month term.

At DongA Bank, the special interest rate being applied is 7.5%/year, for a 13-month term. The condition is a minimum deposit balance of 200 billion VND.

According to forecasts from securities companies, in 2025, the mobilization interest rate is likely to remain stable. The reason is the support from the State Bank's efforts to promote credit in 2025 along with the orientation to continue to closely follow domestic and international market developments, support liquidity to create conditions for credit institutions to supply credit to the economy and promptly have appropriate monetary policy management solutions.

Source: https://dantri.com.vn/kinh-doanh/truoc-tet-gui-tien-ngan-hang-nao-nhan-lai-suat-cao-nhat-20250117161532444.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)