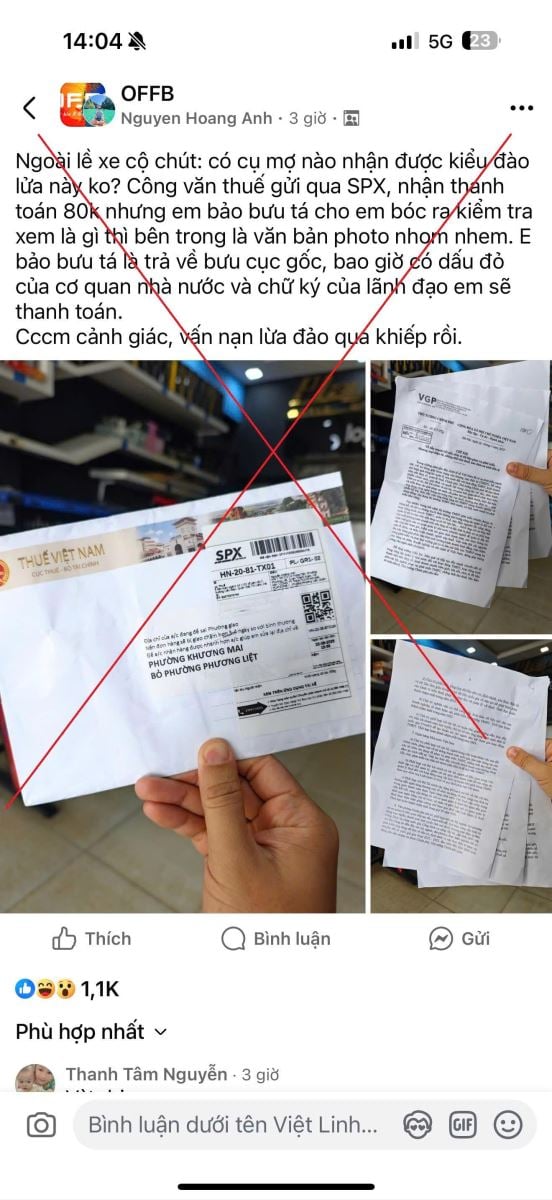

On Facebook, there is information that "The Tax Department sent an official dispatch via SPX, received a payment of 80k, when the recipient opened it, it contained a photocopy of a State agency's document...".

Faced with this situation, on the afternoon of September 24, a representative of the Tax Department confirmed that the above content was fake and not sent from the Tax Department and tax units. "People need to be careful, take precautions and promptly notify the nearest authorities if the subjects contact to send and demand payment for delivery fees," said a representative of the Tax Department.

The Tax Department also requested that Post Offices and units with transportation functions when receiving fake Tax Department envelopes, need to inform the authorities to coordinate in verifying and clarifying.

In Ho Chi Minh City, Ho Chi Minh City Tax has also just issued a warning about the appearance of a Facebook group called "Ho Chi Minh City Tax", impersonating the Tax Department, which can easily cause confusion for taxpayers.

“This Facebook group used images and information from the Tax Department, but this is not an official channel. Currently, the only official fanpage of Ho Chi Minh City Tax has been verified by Facebook with a blue tick,” said a representative of Ho Chi Minh City Tax.

Fanpage: https://www.facebook.com/share/1ABJFx9XQ2/;

Zalo: https://zalo.me/639794428184959354;

Youtube: https://youtube.com/@thuetphochiminh

In addition, the Tax Department is also operating Facebook groups to support taxpayers: Group "Answer - Support for personal income tax settlement"; Group "Support for business households".

Ho Chi Minh City Tax Department recommends that other pages and groups, when reposting articles of the Tax Department, must cite the source in accordance with legal regulations; at the same time, it advises people to be vigilant and avoid being taken advantage of by information from fake pages.

Previously, the Tax Department also warned that there was a phenomenon of some subjects impersonating tax authorities, requesting organizations, enterprises, and business households to update information according to the 2-level local government model.

The tax authority affirms: Organizations, enterprises, and business households are not required to submit citizen identification cards, business registration licenses, or tax registration certificates to update information according to the 2-level local government model. Therefore, taxpayers need to be vigilant against acts of impersonating tax authorities via phone, email, or text messages to defraud and profit.

“Based on the updated tax registration database, the Tax Department will send notifications to organizations, enterprises, and business households about the updated addresses of taxpayers according to the new administrative area and information of the direct tax management agency; taxpayers need to be vigilant and not follow instructions from unofficial information sources,” said a representative of the Tax Department.

In case taxpayers need to update their address according to new administrative boundaries on the Business Registration Certificate, they should contact the business registration authority for instructions according to regulations.

According to the Tax Department, when having problems, taxpayers can contact the hotline of the direct tax authority or the phone numbers and emails of tax support officers listed on the Tax Department's electronic information portal to receive guidance and support on tax policies during the process of arranging according to the 2-level local government model.

Source: https://baotintuc.vn/phap-luat/cuc-thue-len-tieng-viec-gia-mao-lua-nguoi-dan-nhan-cong-van-tra-tien-20250924171035318.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)