The amended Law on Social Insurance, effective from July 1, stipulates that workers working under normal conditions are entitled to pensions when they have paid at least 15 years of compulsory social insurance and are of retirement age. In 2025, the retirement age for men will be 61 years and 3 months, for women will be 56 years and 8 months, and will increase gradually until reaching 62 years old for men in 2028 and 60 years old for women in 2035. The period of social insurance payment as a condition is shortened by 5 years compared to the current period.

|

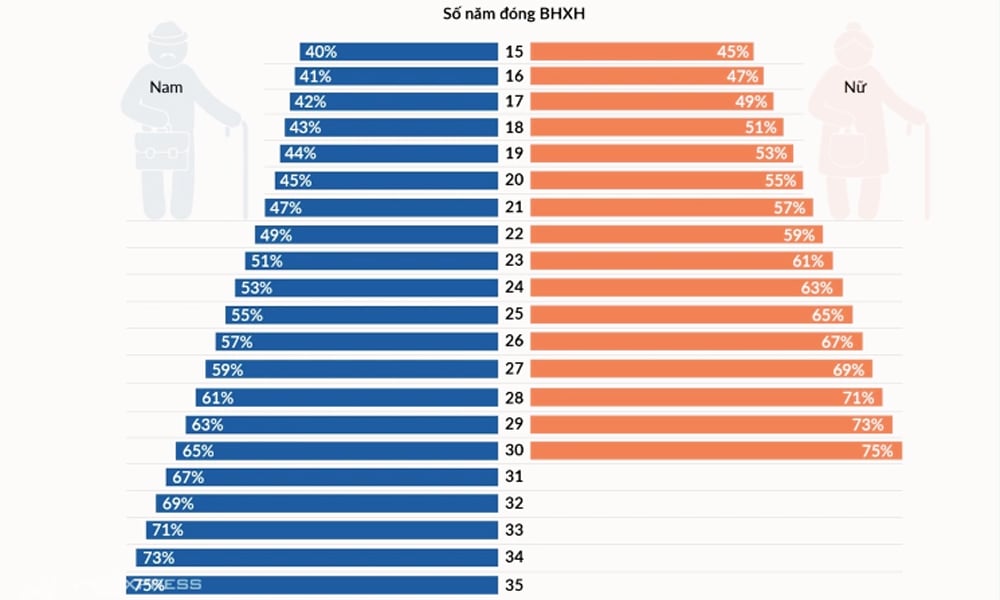

The pension rate corresponds to the number of years of social insurance contributions of retirees from July 1, 2025. |

People with reduced working capacity; working in particularly arduous, toxic, or dangerous occupations; or working in particularly difficult areas can retire earlier, but not more than 5 years compared to regulations. The condition is that the total compulsory social insurance payment period is at least 15 years when doing the above jobs, or working in particularly difficult areas, including areas with regional allowances of 0.7 or higher, before January 1, 2021.

The retirement age lower than the maximum of 5 years also applies to three groups that have paid compulsory social insurance for 15 years or more, including officers and professional soldiers of the army; officers and professional non-commissioned officers, officers and technical non-commissioned officers of the police; people working in cryptography receiving salaries like soldiers; non-commissioned officers and soldiers of the army; non-commissioned officers and soldiers of the police; military, police and cryptography students who are studying and receive living expenses; and regular militia, except in cases otherwise prescribed in specialized laws.

People in these three groups can retire up to 10 years earlier than the regulations if they do heavy, toxic, or dangerous work, work in especially difficult areas, where the regional allowance coefficient is 0.7 before January 1, 2021; or people infected with HIV/AIDS due to accidents while on duty.

The maximum early retirement age of 10 years also applies to underground coal miners, those infected with HIV/AIDS due to accidents while on duty and have paid social insurance for 15 years or more.

People with reduced working capacity who have paid compulsory social insurance for 20 years or more are entitled to a lower pension if they fall into one of the following cases: being up to 5 years younger than the prescribed age and having reduced working capacity from 61 to under 81%; being up to 10 years younger and having reduced working capacity by 81% or more; working in heavy or hazardous occupations for 15 years or more and having reduced working capacity by 61% or more.

The Government will regulate pension benefits for those whose date of birth cannot be determined or whose records have been lost, and other special cases. In the draft decree guiding related contents, the Ministry of Home Affairs proposes that in cases where the date of birth cannot be determined in the labor records but only the year of birth, January 1 of that year of birth will be used as the basis for determining age. For those whose date of birth cannot be determined but only the month and year of birth are available, the first day of that month and year will be used to determine age.

Regarding the level of benefits, the monthly pension of female workers working under normal conditions and reaching retirement age is calculated at 45% of the average salary used as the basis for social insurance contributions, corresponding to 15 years of participation. Each subsequent year of accumulation is added by 2% until reaching a maximum of 75%, corresponding to 30 years of participation.

People with reduced working capacity who retire early will have 2% of their benefits deducted each year. In case of early retirement of less than 6 months, there will be no deduction; from 6 months to less than 12 months, there will be a 1% deduction.

The benefit for male workers is equal to 45% of the average salary used as the basis for social insurance contributions corresponding to 20 years of participation. Each year of contribution is added 2% until the maximum benefit rate is reached 75%, corresponding to 35 years of participation. In the case of male workers participating from 15 years to less than 20 years, the monthly pension is equal to 40% of the average monthly salary used as the basis for social insurance contributions, corresponding to 15 years. After that, for each additional year of contribution, an additional 1% is calculated.

Workers who have contributed over the ceiling of 35 years for men and 30 years for women will receive a one-time subsidy in addition to the maximum benefit rate. This amount is equal to 0.5 times the average salary used as the basis for contribution for each year exceeding the ceiling.

Pensions are adjusted based on the increase in the consumer price index in accordance with the capacity of the state budget and the Social Insurance Fund.

The amended Law on Social Insurance was passed by the National Assembly on June 29, 2024, effective from July 1, 2025. The policy has many major changes in resolving one-time social insurance benefits, shortening the payment period from 20 to 15 years to receive pension, adjusting the pension rate for men who have paid for less than 20 years...

Source: https://baobacninhtv.vn/dieu-kien-huong-luong-huu-tu-ngay-1-7-postid420703.bbg

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)