Domestic gold price today

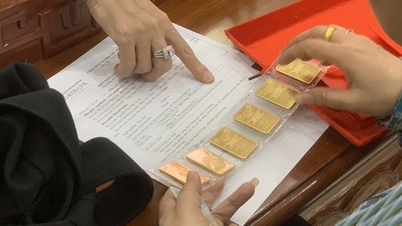

On the morning of July 11, gold brands such as DOJI , SJC, PNJ, Bao Tin Minh Chau are buying at 118.8 million VND/tael and selling at 120.8 million VND/tael, an increase of 200,000 VND/tael in both directions. Particularly, gold brand Phu Quy SJC is buying at 700,000 VND lower than other brands, listed at 118.1 million VND/tael for buying and 120.8 million VND/tael for selling, an increase of 200,000 VND/tael in both directions.

Similarly, gold rings also increased slightly compared to yesterday. Specifically, the price of SJC 9999 gold rings was listed at 114.2 million VND/tael for buying and 116.7 million VND/tael for selling, an increase of 200,000 VND/tael in both directions.

DOJI in Hanoi and Ho Chi Minh City markets increased by VND200,000/tael in both directions, trading at VND115.2 - 117.2 million/tael (buy - sell).

Bao Tin Minh Chau brand gold ring price is 115.3 million VND/tael for buying, 118.3 million VND/tael for selling, up 300,000 VND/tael in both directions.

Phu Quy SJC is buying gold rings at 114.2 million VND/tael and selling at 117.2 million VND/tael, an increase of 200,000 VND/tael in both directions.

PNJ brand gold ring price is buying at 114.3 million VND/tael and selling at 117.2 million VND/tael, up 200,000 VND/tael in both directions.

Domestic gold bar price on the morning of July 11:

| Yellow | Area | Early morning of July 10 | Early morning of July 11 | Difference | ||||||

| Buy | Sell out | Buy | Sell out | Buy | Sell out | |||||

| Unit of measurement: Million VND/tael | Unit of measurement: Thousand dong/tael | |||||||||

| DOJI | Hanoi | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | |||

| Ho Chi Minh City | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | ||||

| SJC | Ho Chi Minh City | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | |||

| Hanoi | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | ||||

| Da Nang | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | ||||

| PNJ | Ho Chi Minh City | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | |||

| Hanoi | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | ||||

| Bao Tin Minh Chau | Nationwide | 118.6 | 120.6 | 118.8 | 120.8 | +200 | +200 | |||

| Phu Quy SJC | Nationwide | 117.9 | 120.6 | 118.1 | 120.8 | +200 | +200 | |||

World gold price today

World gold prices increased slightly, with spot gold prices at 3,324.25 USD/ounce. World gold prices generally increased by 0.35% in the past 24 hours, equivalent to an increase of 11.58 USD/ounce.

With the domestic gold bar price increasing slightly and the world gold price listed at Kitco at 3,324.25 USD/ounce (equivalent to about 105.3 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between the domestic and world gold prices is about 15.5 million VND/tael.

Gold prices on the world market increased slightly. Illustrative photo

According to Kitco News, gold prices rose slightly and silver prices increased sharply near noon on July 10. Investor/trader risk sentiment may have eased slightly, which is providing some support for safe-haven metals. The most recent August gold price increased by $7.10 to $3,328.00/ounce.

Technically, August gold futures bulls have the overall near-term technical advantage. The bulls’ next upside price objective is a close above solid resistance at $3,400 an ounce. The bears’ next near-term downside price objective is a break below solid technical support at $3,200 an ounce.

Gold prices continue to hover around $3,300 an ounce, supported by general investor optimism and a one-month delay in U.S. import tariffs. While shifting investor sentiment could continue to weigh on gold, commodity analysts at Metals Focus expect gold prices to remain well supported for the rest of the year.

“While the global economy appears to have avoided a full-blown trade war, US tariffs are expected to remain at record highs for some time. More importantly, while the US economy has been resilient so far, the inflationary effects of tariffs may take months to be felt by consumers. Therefore, the risk of stagnation is likely to persist,” the analysts said in the report.

Concerns about unsustainable global debt are another factor that could support gold's long-term bullish trend, the British precious metals research firm added. In particular, investors are closely watching US government debt, which has now exceeded $37 trillion. At the same time, the new budget law is expected to increase the budget deficit by nearly $4 trillion over the next 10 years. Concerns about the size of the US government's debt have pushed long-term bond yields higher and pushed the US dollar to its lowest level in years.

“President Trump’s tax and spending bill is expected to increase the budget deficit, keeping concerns about bond supply at the forefront. Investor confidence in the independence of the US central bank will also remain a key issue. Although the role of the US dollar as the main reserve currency is not immediately threatened, long-term concerns about the stability of this currency continue to support gold prices,” analysts said.

Source: https://baohatinh.vn/gia-vang-hom-nay-117-dau-hieu-tang-tro-lai-post291505.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)