Coffee prices continue to recover amid weather concerns

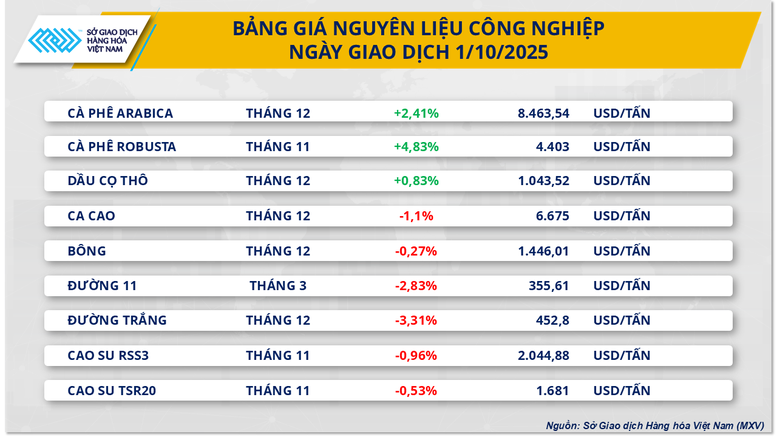

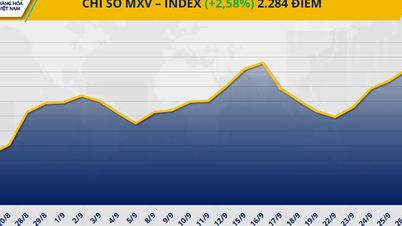

Closing yesterday's trading session, the industrial raw material market continued to be volatile. In particular, the strong recovery of two coffee products stood out. Specifically, Robusta coffee prices increased by more than 4.8% to 4,403 USD/ton while Arabica coffee prices also recorded an increase of more than 2.4%, reaching 8,463 USD/ton.

According to MXV, concerns about weather developments in the Central Highlands and Brazil were said to be the main factors driving the rise in coffee prices yesterday. In Vietnam, heavy rains caused by Typhoon Bualoi flooded many farms and roads in some coffee-producing regions, making cultivation difficult for farmers. Meanwhile, in Brazil, according to Climatempo forecasts, hot and dry weather will prevail in the coming days, which increases concerns about the important flowering period of the 2026 crop.

Meanwhile, in Brazil, the world’s largest coffee supplier, forecasts of hot and dry weather in the coming days have investors worried that the flowering stage of the 2026 crop will be adversely affected. These contrasting but equally unfavorable climatic fluctuations reinforce expectations that coffee prices will remain high in the short term amid increasingly unpredictable global supply and demand.

Aside from the weather, the long-term outlook for the coffee market remains buoyed by tight supplies. In addition, strong demand has caused Arabica coffee inventories monitored by ICE to continue to decline sharply, recording only 563,351 bags as of October 1 - the lowest in the past 1.5 years.

In another development, the market is awaiting a meeting between President Donald Trump and Brazilian President Luiz Inácio Lula da Silva, with the expectation of discussing the 50% tariff that the US imposed on Brazilian coffee.

In the domestic market, transactions of old-crop coffee are slow due to limited supply. Some businesses are taking advantage of the situation to sell off their stocks to prepare for the new crop, while the new crop has not yet been priced.

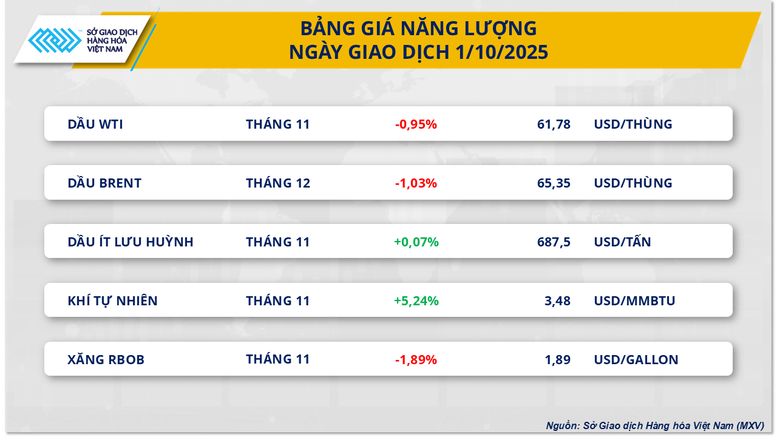

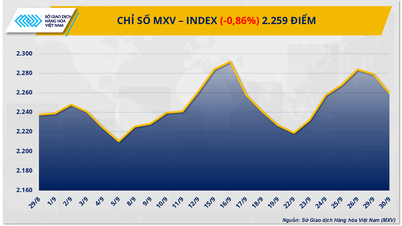

On the other hand, according to MXV, the energy market yesterday also recorded relatively mixed developments. In particular, world crude oil prices continued to decline for the third consecutive session.

Specifically, Brent oil price fell to its lowest level since early June, at 65.35 USD/barrel, corresponding to a decrease of about 1.03%; while WTI oil price also closed the session with a decrease of 0.95%, stopping at 61.78 USD/barrel - the lowest level since late May.

Yesterday, the latest weekly report from the US Energy Information Administration (EIA) further reinforced the downward momentum in oil prices as the market is facing the prospect of a global oversupply.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-ca-phe-dan-dau-xu-huong-102251002113359564.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)