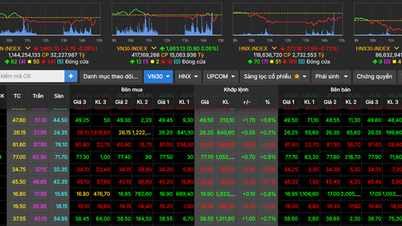

Vietnam’s rice export prices hit an eight-month high last week due to tight supplies. 5% broken fragrant rice was offered at $455-$460 a tonne on August 28, the highest since early January, the Vietnam Food Association said.

A trader in Ho Chi Minh City said supplies are tightening while demand remains stable, ahead of the Philippines' 60-day ban on rice imports that takes effect from September 1.

Regarding the domestic market, according to the Institute of Strategy and Policy on Agriculture and Environment, last week in Can Tho, Jasmine rice was priced at 8,400 VND/kg; IR 5451 rice was 6,200 VND/kg; OM 18 was 6,700 VND/kg; ST25 was 9,500 VND/kg.

According to the update of the Department of Agriculture and Environment of An Giang, the prices of some types of fresh rice purchased by traders are: IR 50404 rice at 5,700 - 5,900 VND/kg; OM 380 rice from 5,700 - 5,900 VND/kg; OM 5451 rice fluctuates at 5,900 - 6,000 VND/kg; OM 18 and Nang Hoa from 6,000 - 6,200 VND/kg; Dai Thom 8 from 6,100 - 6,200 VND/kg...

Regarding rice products in the retail market in An Giang, regular rice costs from 13,000 - 14,000 VND/kg; long-grain fragrant rice from 20,000 - 22,000 VND/kg; Jasmine rice from 16,000 - 18,000 VND/kg; common white rice 16,000 VND/kg, Nang Hoa rice 21,000 VND/kg; Huong Lai rice 22,000 VND/kg; Taiwanese fragrant rice 20,000 VND/kg; Soc rice usually fluctuates at 17,000 VND/kg; Soc Thai rice costs 20,000 VND/kg; Japanese rice costs 22,000 VND/kg...

The price of IR 504 raw rice is at 8,500 - 8,600 VND/kg, IR 504 finished rice is from 9,500 - 9,700 VND/kg; OM 380 raw rice is from 8,200 - 8,300 VND/kg; OM 380 finished rice fluctuates at 8,800 - 9,000 VND/kg.

For by-products, the price of by-products of all kinds fluctuates between 7,200 - 9,000 VND/kg. The price of dry bran is at 8,000 - 9,000 VND/kg.

The Ministry of Agriculture and Environment said that as of August 25, the Mekong Delta provinces had planted 1.829 million hectares of the 2025 Summer-Autumn crop, with a harvested area of about 1.085 million hectares, with a yield of 60.15 quintals/hectare, and an estimated output of 6.526 million tons of rice. The Autumn-Winter crop has been planted on 581,000 hectares out of the planned 700,000 hectares, reaching 83%. The Winter-Spring crop has been planted on 145,000 hectares out of the planned 337,000 hectares, reaching 43%.

In the Asian rice market, Indian rice prices remained stable while Thai rice prices fell due to excess inventories amid stable demand across the regions.

India’s 5% broken parboiled rice was quoted at $371-$376 a tonne, unchanged from last week. India’s 5% broken white rice was quoted at $363-$369 a tonne this week. A Mumbai-based dealer said overseas buyers are slowly increasing their purchases of Indian rice as they realize prices have bottomed out.

Meanwhile, the price of 5% broken rice from Thailand has decreased from 365-370 USD/ton to 355 USD/ton last week due to excess supply.

A Bangkok-based trader said there was talk of India supplying an additional 20 million tonnes of rice and buyers were waiting for the additional supply. Another trader warned that Thai rice prices could fall further, especially as supplies are high in all countries but demand remains flat.

Thailand hopes to achieve its rice export target of 7.5 million tonnes this year by seeking more contracts in high-demand markets, a Commerce Ministry official said.

Regarding the US agricultural market, analysts said that corn futures on the Chicago Board of Trade (CBOT) increased on August 29, supported by strong international demand, concerns about disease in the US Midwest and technical support.

Specifically, the price of corn for delivery in December 2025 increased by 10.25 cents to 4.2025 USD/bushel. The price of wheat for delivery in the same period also increased by 5.25 cents to 5.3425 USD/bushel. Meanwhile, the price of soybeans for delivery in January 2024 increased by 6.5 cents, equivalent to 0.3%, to 10.545 USD/bushel (1 bushel of wheat/soybean = 27.2 kg; 1 bushel of corn = 25.4 kg).

Favorable prospects for the U.S. soybean and corn harvests also limited gains in Chicago trading.

Soybean prices climbed to a two-month high last week, boosted by hopes that China would resume buying US farm goods after months of shunning supplies because of the trade conflict. However, no such purchases have been confirmed.

Markets will be closely watching US-China talks in the coming days, as China's top trade negotiator Li Chenggang is expected to arrive in Washington.

Soybean gains are limited by a lack of demand from China, which will limit further gains until Chinese buyers show signs of increasing purchases, said Randy Place, an analyst at consultancy Hightower Report.

The world coffee market shows that on the London floor, the price of robusta coffee futures has decreased simultaneously: the September 2025 contract is down to 5,008 USD/ton, the November contract is down to 4,808 USD/ton, and the further terms also lost from 50 - 70 USD/ton.

Similarly, the price of Arabica coffee on the New York floor fell sharply, with the September 2025 futures contract falling 6.05 cents to only 387.75 cents/pound. The December 2025 - July 2026 futures contracts also fell 6 - 7.8 cents/pound (1 pound/lb = 0.4535 kg).

On August 30, domestic coffee prices continued to decrease following the general trend of the world market. In the Central Highlands, the price of raw coffee beans fluctuated from 121,700 - 122,500 VND/kg, down from 1,300 - 1,500 VND/kg compared to the previous session. Specifically, Dak Lak recorded 122,300 VND/kg, Lam Dong 121,700 VND/kg, Gia Lai 122,000 VND/kg.

The average coffee price in the whole market reached 122,300 VND/kg, down 1,400 VND.

The world coffee market is being greatly affected by the new trade policy of the US. Since August 6, the administration of President Donald Trump has imposed a 50% tax on coffee imported from Brazil - the world's largest coffee exporter, which is also the source of 1/3 of US imports. This decision has caused US roasters to limit new contracts with Brazil, shifting to supplies from Central America and Colombia, but at a higher cost than the listed price on the ICE exchange.

According to Mr. Marcio Ferreira, President of the Brazilian Coffee Exporters Council (Cecafe), the tariff policy has disrupted the market, creating an unstable environment and pushing global arabica coffee prices up more than 30% in August. He commented that the market has not yet found a “price peak”, while Brazil’s 2025 output is about 10% lower than expected and is at risk of further decline due to adverse weather.

Source: https://baolaocai.vn/thi-truong-nong-san-viet-nam-da-xuat-khau-gan-59-trieu-tan-gao-post881091.html

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)