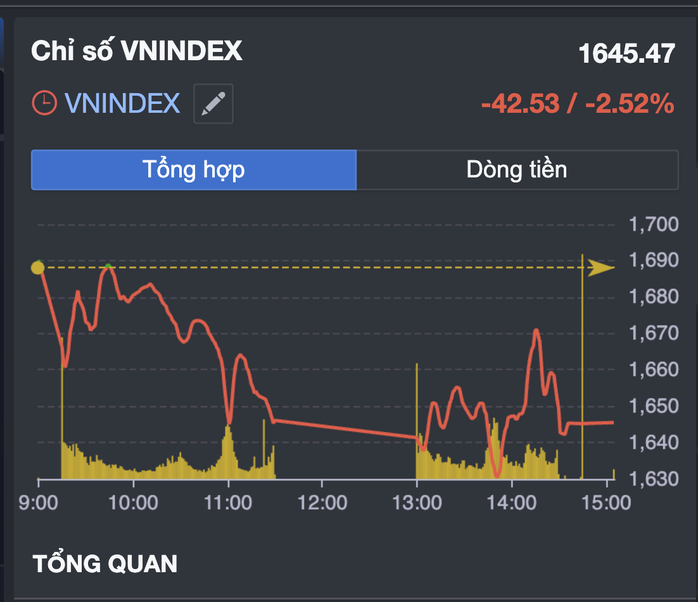

Investors experienced a "stormy" weekend trading session on the stock market, when the VN-Index at one point plummeted to 58 points. At the end of the session, the market recovered to 1,645 points but still lost more than 42 points. A series of stocks fell sharply or hit the floor - investors were worried about the correction trend.

Liquidity at the end of the week reached 2.7 billion USD on all 3 exchanges, with the transaction value on HOSE alone being approximately 63,000 billion VND. What is happening to the VN-Index at the moment? Is the adjustment normal or abnormal in the investment strategy for this period?

Reporter of Nguoi Lao Dong Newspaper recorded the opinions of some securities company experts.

Mr. Dinh Minh Tri, Director of Individual Client Analysis - Mirae Asset Securities Company:

Technical recovery is an opportunity to reduce stock exposure and reduce risk.

Since mid-June, the market has been on a strong uptrend. In the past 9 weeks, the VN-Index has been increasing continuously and quite hotly, so a correction is necessary.

Mr. Dinh Minh Tri

This is a normal trading session. The upward pressure has been strong for many consecutive weeks. For example, VPBank 's stock code VPB has had consecutive sessions with ceiling prices right after opening, pushing the price up very high - the weekend session saw profit-taking, even falling to the floor price, which is understandable. This is just a necessary profit-taking phase for stocks that have increased rapidly in the recent period.

Some studies show that when the VN-Index increases by 50-70% in a short period of time, there will be an adjustment within the range of 10-20%, even 25%. The VN-Index has now begun to enter a correction phase. After 9 consecutive weeks of increase, a decrease is inevitable.

The common correction wave usually lasts 1-3 weeks, especially in the context of the current short-term cash flow - the VN-Index decline may last until mid-September. At that time, the market will have more positive supporting information such as the third quarter business results which are expected to be positive; the possibility of a US interest rate cut...

VN-Index had a "roller coaster" session, many stocks hit the floor after a series of strong increases

At this time, for short-term investors, the strategy is to control risk and reduce the proportion when necessary. During the correction period, stocks that have dropped dramatically will often experience a technical recovery, which is an opportunity to reduce the proportion and reduce risk. Short-term investors need to be especially careful, because the market is very sensitive at this stage and is easily affected by unexpected news. If you do not manage risk well, your account will be damaged.

For medium and long-term investors, the upcoming period opens up opportunities. Cash flow in the market is still abundant, shown by the high balance of investor deposits at securities companies in the second quarter of 201025. When the market corrects, this may be a reasonable entry point, stock selection needs to focus on fundamental factors, because this factor will determine the next wave.

Mr. Nguyen The Minh, Director of Analysis of Individual Clients, Yuanta Vietnam Securities Company:

Don't rush to buy stocks at the bottom yet.

After the recent period of overheating, the VN-Index adjustment is necessary. Last week, the market had many warning factors such as increased cash flow, increased exchange rate pressure, and strong net selling by foreign investors in the last 10 sessions. The margin ratio (loan capital) is quite high. Since the second quarter, the margin ratio on market capitalization has exceeded 5% - huge margin pressure. As a result, many securities companies have "hit the ceiling" of margin.

Mr. Nguyen The Minh

Looking at the current divergence, the market breadth has narrowed. Midcap and smallcap stocks have been sold off heavily in the last two sessions, while largecap stocks have only risen thanks to banking stocks. The market is not really healthy and therefore correction pressure is certain to occur.

The pressure to adjust is normal, will it last? In my opinion, the possibility of the market correcting in the range of 7-10% is quite high. Another point worth noting is that the valuation of the market, especially the banking group, has increased.

The group's price-to-book (P/B) ratio has reached 2 times, and historically, when P/B reaches this level, adjustment pressure often occurs. If the banking group adjusts down, it will certainly have a strong impact on the general index.

VN-Index reached its lowest level of 1,632 points before recovering at the end of the session.

The strategy for investors using margin is to lower the ratio to a low level; the stock ratio should be brought to a balanced level, about 50-60% of the portfolio. In fact, although the VN-Index has increased very strongly in the past 2-3 sessions, many people's portfolios are not sure to increase, because most of the increase comes from the banking group, while other stocks have decreased sharply. Therefore, stocks with low profits should consider selling some, in case the market falls further.

Buying new stocks is not advisable because of the high risk, especially for midcap and smallcap stocks. The indexes of these stocks have confirmed the downtrend, so you should not rush to buy the bottom when the market corrects strongly.

Looking longer term, the decline of VN-Index is likely to be short term only, while the medium and long term trend is still upward.

Source: https://nld.com.vn/chuyen-gia-noi-gi-sau-phien-chung-khoan-di-tau-luon-thanh-khoan-27-ti-usd-196250823113236816.htm

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

![[Photo] Prime Minister Pham Minh Chinh attends the 1st Hai Phong City Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/676f179ddf8c4b4c84b4cfc8f28a9550)

Comment (0)