(Photo: THANH DAT)

In the domestic market, gold prices of all brands are having strong downward adjustments after a series of consecutive days of setting new peaks.

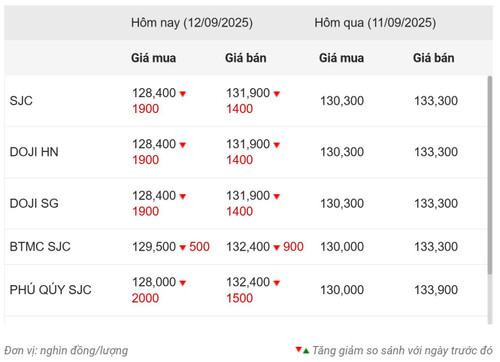

Specifically, at 11:30 a.m. on September 12, Saigon Jewelry Company (SJC) listed the buying and selling prices of SJC gold bars at 128.4-131.9 million VND/tael, down 1.9 million VND and 1.4 million VND/tael, respectively. The difference between buying and selling was up to 3.5 million VND/tael.

The price of SJC 9999 gold ring is 125 million VND/tael for buying and 128 million VND/tael for selling, down 1.6 million VND/tael compared to the previous session. The difference between buying and selling is 3 million VND/tael.

DOJI gold bar prices in Hanoi and Ho Chi Minh City were traded at 128.4 million VND/tael for buying and 131.9 million VND/tael for selling, down 1.9 million VND and 1.4 million VND/tael respectively.

This brand listed the buying and selling price of Doji Hung Thinh Vuong 9999 gold ring at 128.4-131.9 million VND/tael. The difference between buying and selling is 3.5 million VND/tael.

Gold price statistics of Dragon Viet Online Service Joint Stock Company VDOS - Updated at 11:30 a.m. on September 12.

PNJ Gold is currently buying at 126.2 million VND/tael and selling at 129.2 million VND/tael, down 1.1 million VND compared to the previous closing price.

Thus, from September 8-9 until now, although the world gold price has not fluctuated much, the domestic SJC gold bar price has decreased by 3.9 million VND/tael following the Prime Minister's direction at the meeting with the Policy Advisory Council on the afternoon of September 7. At the meeting, Prime Minister Pham Minh Chinh assigned the State Bank to receive opinions, study solutions, use available tools, balance gold supply and demand, prevent the abuse of policies, and strengthen inspection, supervision, and prevention of gold smuggling.

Currently, the difference between domestic gold bar prices and world gold prices, although still high, has been narrowed to about 16 million VND/tael (excluding taxes and fees).

As of 11:30 a.m. September 12 (Vietnam time), the world gold price increased by 11.2 USD compared to the previous closing price to 3,650.4 USD/ounce.

World gold prices continue to maintain their historical peak, trading above the 3,600 USD/ounce mark as persistent inflation and increasing risk of economic recession are boosting demand for gold as a safe haven asset.

However, the US Federal Reserve's neutral stance and stable interest rates until the end of 2025 is likely to limit the attractiveness of this precious metal in the short term.

Lachman, former managing director at Salomon Smith Barney and deputy director of the International Monetary Fund's (IMF) policy development and review department, described the 2025 gold rally as "unbelievably spectacular." He noted that the precious metal has outperformed all other major financial assets, reflecting concerns that the United States will use inflation to escape its debt.

The trend of central banks shifting away from the US dollar and continuously adding gold to their reserves is also another important factor behind the recent rise in gold prices.

Currently, the USD-Index increased to 97.62 points; the yield on 10-year US Treasury bonds inched up to 4.034%; US stocks were green after the inflation report; oil prices reversed and fell about 2% due to concerns about weakening demand, trading at 65.91 USD/barrel for Brent oil and 61.89 USD/barrel for WTI oil.

Nhandan.vn

Source: https://nhandan.vn/gia-vang-ngay-129-vang-mieng-sjc-giam-39-trieu-dongluong-sau-chi-dao-cua-thu-tuong-post907658.html

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)