Mr. Phan Manh Ha, Business Director, VNDirect Securities Company, said that in the current stock market, there is no bad news but instead there are driving forces for growth.

Accordingly, the Government and the Prime Minister have given strong instructions for the economy to achieve the growth target of 8% or more in 2025 and double digits in the following years. This information will stimulate cash flow into the market.

In addition, the information that Vietnam's stock market will be upgraded from now until the third quarter has strongly impacted investor sentiment.

Along with that, the market has been quite gloomy for many months, investors have been holding money and waiting, now with positive information, they are more likely to invest.

Therefore, according to Mr. Ha, this is the time when cash flow is returning to stocks. " From now until the second quarter, the market will be very good. Some groups will meet growth expectations, such as public investment, manufacturing and securities. The market can reach 1,400 points ," Mr. Ha said.

Stocks have surpassed the 1,300 point threshold. (Illustration photo).

Similarly, Mr. Nguyen The Minh, Director of Research and Development of Individual Clients at Yuanta Securities Vietnam, also said that the positive factors of the market took place a week ago when the Government introduced a series of solutions to stimulate economic growth right from the beginning of the year. And to grow, a series of policies have been released for public investment, infrastructure investment, and continued implementation of the VIII power plan. Along with that, the Prime Minister has asked banks to maintain low interest rates to stimulate credit growth right from the beginning of the year.

For investors, they expect the stock market upgrade to take effect in September, to continue affirming this as an important capital channel for the economy and businesses.

“When the Vietnamese stock market is upgraded to an emerging market, this growth rate will certainly be much larger,” Mr. Minh predicted, emphasizing that there is still room for the VN-Index to grow beyond 1,300 points, possibly reaching 1,400 points. Thus, according to this expert, in the coming days, the VN Index will continue to increase quite high.

Regarding the groups of stocks that can continue to increase and attract investors, Mr. Minh commented: "Currently, the accumulation of investors' cash flow may continue to return to the market with the banking, securities, real estate, especially industrial real estate groups."

Meanwhile, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy at VNDirect Securities, also said that concerns about exchange rate risks have been "largely" reflected in prices and the market is gradually shifting to other more topical stories such as the 8% GDP growth target and upcoming government policies to boost the economy.

"Last week, the National Assembly officially approved the GDP growth target of 8% or more in 2025. This is a very ambitious target, so it is expected that the Government will soon introduce drastic policies to realize this growth target, including expanding fiscal and monetary policies," said Mr. Hinh.

The weekend also saw important news related to steel stocks when the Ministry of Industry and Trade issued Decision No. 460/QD-BCT, applying temporary anti-dumping tax on hot-rolled coil (HRC) products from China and India. This information will have a positive impact on steel stocks, especially HPG.

With current developments, Mr. Hinh believes that the VN-Index may continue to move upward and test the strong resistance level of 1,300 points next week.

"The market may experience some fluctuations in this area when a group of investors realize profits. However, the probability of the market surpassing 1,300 points has increased significantly and investors should take advantage of any short-term corrections to increase the proportion of stocks, prioritizing businesses in industries with support stories such as public investment, construction materials, banking, residential real estate and securities," Mr. Hinh analyzed.

PHAM DUY - Vtcnews.vn

Source: https://vtcnews.vn/chuyen-gia-dong-tien-dang-tro-lai-vn-index-co-co-hoi-dat-1-400-diem-ar928020.html

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

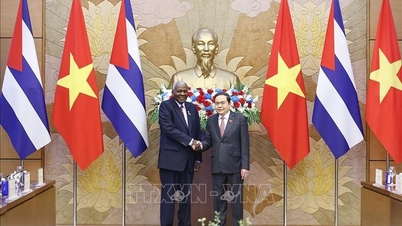

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)