Challenges of rising prices and large income gaps

In the meeting on the afternoon of September 22, Prime Minister Pham Minh Chinh gave many important instructions related to the real estate market. In particular, the Prime Minister raised the issue of how many people need houses but cannot buy them because the prices are too high; who has the money to buy apartments that cost over 70 million or over 100 million VND per square meter? The Prime Minister requested the implementation of solutions to reduce real estate prices and increase supply to meet supply and demand.

The continuous increase in apartment prices in recent times is a “hot” issue, receiving the attention of the people. Many market research units and experts have continuously mentioned this issue and given warnings.

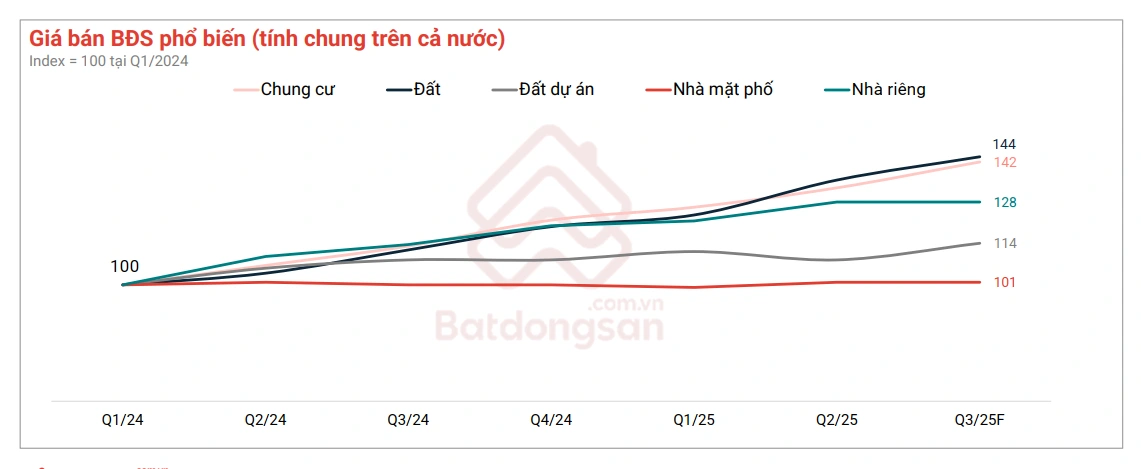

Batdongsan.com.vn's August report mentioned that in the past 2 years, the common real estate selling price (in general nationwide) has maintained an upward trend in most types, of which the strongest increase is land (up 44%) compared to the first quarter of 2024 and apartments increased 42%. Other types including private houses, project land and townhouses increased by 28%, 14% and 1% respectively in the same period.

Real estate prices increased in many types in 8 months (Source: Batdongsan.com.vn)

According to Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn - the fact that selling prices continue to increase is the result of strong money supply growth through flexible monetary policies aimed at high economic growth; the prolonged scarcity of primary supply, especially in large cities, along with investors' confidence in the potential for future price increases.

At the same time, he pointed out the challenge of housing accessibility for low-middle income people. This situation may continue if legal and supply bottlenecks are not thoroughly resolved.

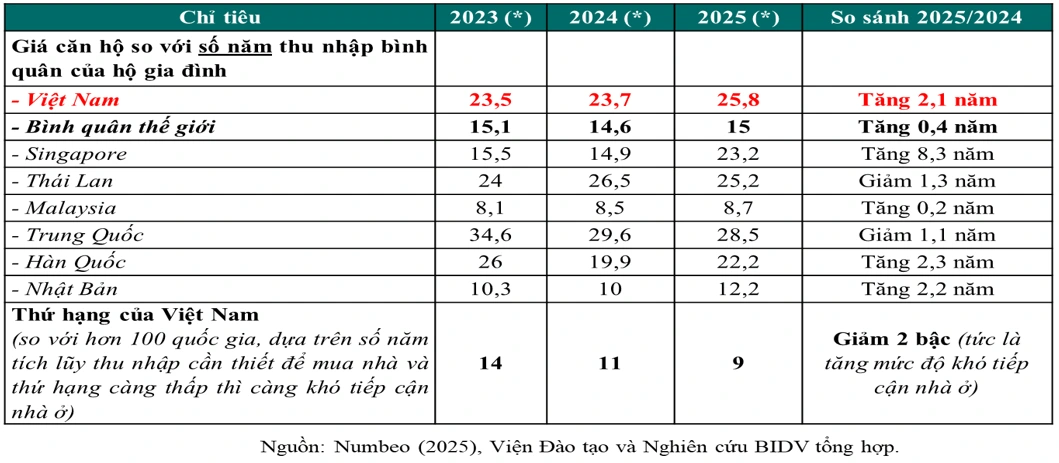

Meanwhile, expert Can Van Luc, in a recent seminar, said that a civil servant in Vietnam needs 26 years of continuous work to be able to buy an apartment. This difference reflects the reality that real estate prices increase much faster than income, creating a large gap compared to the world average (15 years).

Mr. Luc emphasized that the problem is that the gap is increasing day by day, and income growth cannot keep up with housing prices. Therefore, experts believe that real estate prices need to be controlled.

People need 26 years to buy an apartment (Source: Dr. Can Van Luc shared).

Apartment prices in big cities are skyrocketing.

According to a survey by Dan Tri reporters , recently, many apartment projects in Hanoi have been opened for sale. However, the current prices are concentrated in the high segment.

Specifically, a project in Dai Mo ward (Hanoi) has an opening price of 80-120 million VND/m2. In Tu Liem ward, an apartment project located on Le Quang Dao street has an opening price of about 130 million VND/m2 (excluding VAT and maintenance fee).

A project in Viet Hung ward is also expected to cost over 120 million VND/m2. Notably, a project in Cau Giay ward is expected to cost from 150 million VND/m2. Or a newly launched project in Xuan Dinh ward is also opening for sale at 100 million VND/m2.

Expert Le Dinh Chung said that the average price of apartments in Hanoi is fluctuating between 70-80 million VND/m2. In addition, the market has seen the emergence of many high-end, branded projects with prices above 100 million VND/m2.

According to him, these projects are often in prime locations in the center of Hanoi. The project developer intends to sell to high-income customers, not to the majority of customers. However, the liquidity of products above 150 million VND/m2 will not be high, because they are picky about customers.

He said that the apartment market in particular and the real estate market in general are slowing down. Therefore, high-end and luxury apartment products are also very illiquid.

Regarding the possibility of price increases for luxury and branded apartments, Mr. Chung said that currently, most of them are primary products so investors have set high prices. Therefore, it will take more time to have the opportunity to increase prices. In addition, the input costs of the project are currently very high, and the implementation progress is slow. At the same time, project developers have invested more in the product so they will expect a high profit margin.

Similar to Hanoi, the real estate market in Ho Chi Minh City, especially the apartment segment, has recorded a rapid price increase recently.

In fact, the price of newly opened apartments in Ho Chi Minh City has been increasing continuously recently, especially for primary products. The price is anchored high, at 100-200 million VND/m2, even approaching townhouses.

In the old District 2 area, around the An Phu intersection, a foreign investor started the third phase of a high-rise project, introducing apartments to the market at around 130-220 million VND/m2. Along the parallel road to the Ho Chi Minh City - Long Thanh Expressway, a restarted project has an average price of around 120 million VND/m2. Nearby, apartments in the metropolitan area of over 117 hectares also cost from 160 million VND/m2.

Mr. Le Hoang Chau - Chairman of the Ho Chi Minh City Real Estate Association (HoREA) - statistics show that in 2024, the price of apartments in Ho Chi Minh City will increase to an average of 90 million VND/m2. From 2020 to now, the rate of increase in housing prices in Ho Chi Minh City has reached 15-20% per year.

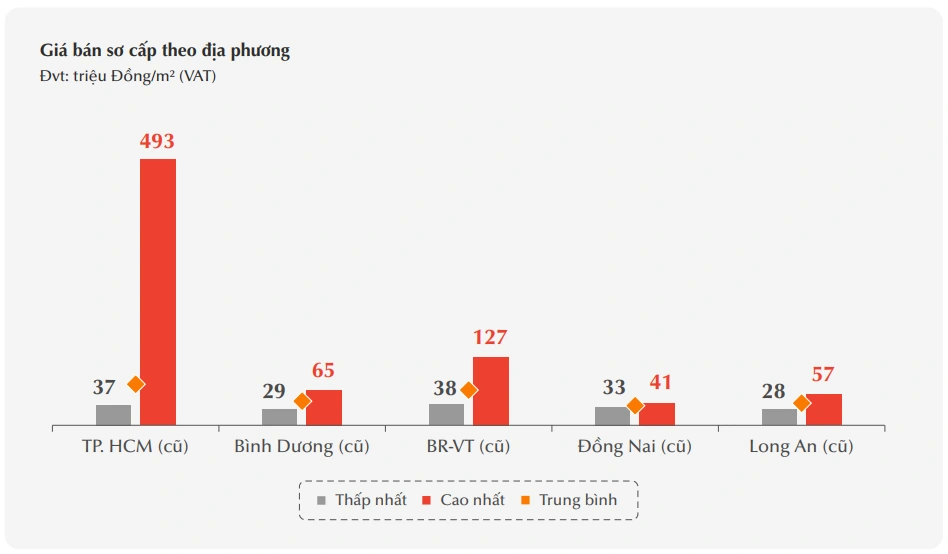

Updating the first 8 months of this year, Mr. Vo Hong Thang - Deputy General Director of DKRA Group - stated that the average selling price of primary apartments in Ho Chi Minh City (old) increased by 12-18% compared to the same period last year, with some individual projects having the highest price of 493 million VND/m2. In Binh Duong (old), the average price also increased by 8-10% compared to the same period last year.

Selling price of apartments in Ho Chi Minh City (old) and neighboring localities (Source: DKRA).

Reasons for high apartment prices

The reason for the increase in apartment prices in Ho Chi Minh City has been analyzed by many experts in recent times. First is the problem of decreasing supply. A report by CBRE Vietnam stated that in the second quarter, the supply of apartments in Ho Chi Minh City (old) although doubled compared to the previous quarter, but in the first 6 months was still 16% lower than the same period. This unit also recorded the lowest 6-month apartment supply in a decade in Ho Chi Minh City.

Sharing the same view, experts from Savills Vietnam said that Ho Chi Minh City has also faced a shortage of supply in recent years. The city set a target of developing about 235,000 new houses in the 2021-2025 period, but only achieved 24% of the target and still lacked 179,000 units. The gap between supply and demand has widened due to issues related to project legality.

Another reason is the imbalance in supply to the market. Mr. Le Hoang Chau said that in the first half of this year, Ho Chi Minh City only had 4 commercial housing projects with more than 3,300 luxury apartments eligible to mobilize capital. The market has no mid-range and affordable apartments - a situation that has been happening continuously for many years.

Previously, from 2021 to now, the supply of new housing projects in Ho Chi Minh City no longer has affordable commercial housing with prices below 30 million VND/m2 and there is a severe shortage of social housing. In contrast, the high-end housing segment from 2020 to 2023 has continuously dominated, accounting for about 70% of the total supply.

He warned that in the short term, the housing market in Ho Chi Minh City will continue to face a shortage of supply, especially in the mid-range and affordable segments. Housing prices will continue to rise, beyond the financial capacity of the majority of urban residents.

Sharing the same view, Ms. Trang Bui - General Director of Cushman & Wakefield Vietnam - admitted that market supply is increasingly concentrated in the high-end and luxury segments. There is no new supply in the central area, the market is led by typical real estate developers. The increase in primary selling prices reflects the lack of supply in the affordable and mid-range segments.

Ms. Trang predicts that next year could be the starting point of a new recovery cycle, but it will be slow, selective and highly differentiated. The challenge of the HCMC market is that the average primary selling price is still too high compared to the average income, it takes more than 20 years to buy a house.

Prices will continue to increase by 5-10% per year, depending on the area, increasing according to product quality, not a widespread increase. Supply may increase by 25-30% per year from this year, but still lower than the peak in 2022. The market will welcome new supply with legal "unencumbers".

Another reason for the increase in apartment prices is the pressure on input costs, especially land costs, land use fees, and construction costs. These costs account for a large part of the total project investment costs. Experts believe that only when input costs are controlled at a reasonable level will real estate prices stabilize.

Ms. Do Thu Hang - Senior Director of Savills Hanoi - said that Hanoi is synchronously implementing many solutions for institutional reform, infrastructure development, and piloting housing projects. Notably, many projects are being considered for implementation in areas outside the 3 - 3.5 belt. When the procedures are completed and the products are launched on the market, it will have a positive impact on the price level.

However, an important factor is that land use costs currently account for a large proportion of the total cost. If this cost is calculated reasonably, ensuring the harmony of interests between the State and enterprises, housing prices can be reduced to a level more suitable to people's ability to pay. At the same time, preferential mechanisms on tax, credit or land for the affordable housing segment are also necessary to promote the development of this product line.

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)