From Huawei Technologies to Alibaba Group, China's top tech companies are racing to introduce the latest advances in artificial intelligence (AI) chips.

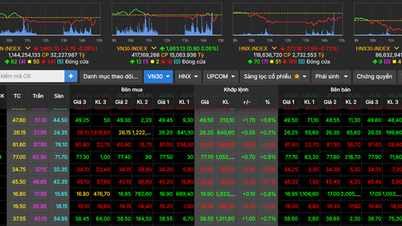

This growing confidence is attracting investor attention, triggering a $240 billion stock rally in China.

On September 18, Huawei announced its three-year chip development roadmap for the first time, emphasizing plans to build “supercomputer clusters” with high-speed AI chips to replace Nvidia’s processing accelerator line, which is limited in China.

The moves, which follow recent announcements from Baidu, Cambricon Technologies and others, suggest that 2025 could be a turning point in China’s years-long effort to develop its own chips amid U.S. sanctions. But analysts say it will take time to test the commercial viability of these designs.

Nvidia currently dominates the AI chip market, even Advanced Micro Devices (AMD) and Intel are outclassed. Meanwhile, ASML holds the technology for high-end chip manufacturing equipment, while TSMC makes most of the world 's advanced chips, but is banned from working with many Chinese companies due to US sanctions.

Still, investors are hopeful that the flurry of announcements from Chinese companies will translate into real products soon. Chinese tech stocks have surged to their highest levels since 2021, led by a more than 37% surge in Alibaba shares since late August 2025.

“China will have many more ‘DeepSeek moments’, not only in AI but also in many other innovative industries where the country is growing strongly,” said Francis Tan, chief strategy officer at CA Indosuez Wealth Asset Management.

For years, the US has sought to limit China’s access to US technology, fearing it would strengthen its economic and military power. In response, China has pushed its domestic companies to move up the value chain. Controls, including on Nvidia chips, have become a focus of US-China trade talks.

Chinese chips are still far behind Nvidia and AMD, but many have found creative ways to overcome the limitations. Huawei says it can connect up to a million chips to close the performance gap.

“Huawei has just announced an ambitious AI chip roadmap,” said Charlie Dai, an analyst at Forrester Research. “While it admits its chips are inferior to Nvidia in terms of single-chip performance, Huawei makes up for it with large-cluster connectivity, its own transmission protocol, and cost advantages.”

The rally in Chinese tech stocks began after Alibaba reported triple-digit growth in AI revenue and better-than-expected cloud revenue for the month of August 2025. The company’s stock added $50 billion in value in the next session alone.

In total, the 30 companies in the Hang Seng Tech Index added a total of $240 billion in capitalization.

Other companies are also stepping up investment. Baidu has signed a 1 billion yuan (S$1.86 billion) deal to supply servers using Kunlun chips to China Mobile. Cambricon reported record profits in the first half of the year, a sign that domestic chips are gaining ground domestically.

The Chinese government has also been actively supporting the sector. This summer, Chinese regulators urged domestic companies to stop using Nvidia’s H20 chips, which the Trump administration has approved for sale to China. This week, the Cyberspace Administration of China ordered a halt to testing of the RTX Pro 6000D workstation-class graphics card, which can be converted for AI applications.

Bloomberg Intelligence expert Michael Deng said the move, if true, would “represent a calculated escalation in US-China technology competition,” while redirecting spending to domestic chips and reinforcing China’s message of technological autonomy.

Much of the focus is now on the ability of manufacturers like Semiconductor Manufacturing International Corp (SMIC) to increase the yield and proportion of chips that can be used for large-scale production. SMIC is testing domestic equipment to achieve this goal, according to the Financial Times./.

(TTXVN/Vietnam+)

Source: https://www.vietnamplus.vn/lan-song-chip-ai-kich-hoat-dot-tang-gia-co-phieu-cong-nghe-trung-quoc-post1063251.vnp

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)